Top Retirement Planning Mistakes Every Indian Investor Must Avoid

Retirement planning in India is now more crucial than ever. As life expectancy rises, healthcare costs soar, and family structures evolve, securing your financial future in your golden years isn’t just an option—it’s a necessity. However, despite its undeniable importance, many Indians inadvertently fall prey to common Retirement Planning Mistakes that can severely impact their financial security and peace of mind during their post-retirement life.

Understanding these common pitfalls and actively working to avoid them is the cornerstone of building a robust retirement plan. This guide will walk you through the most frequent errors in retirement planning, offering practical solutions to help you ensure a comfortable, dignified, and worry-free life after you stop working.

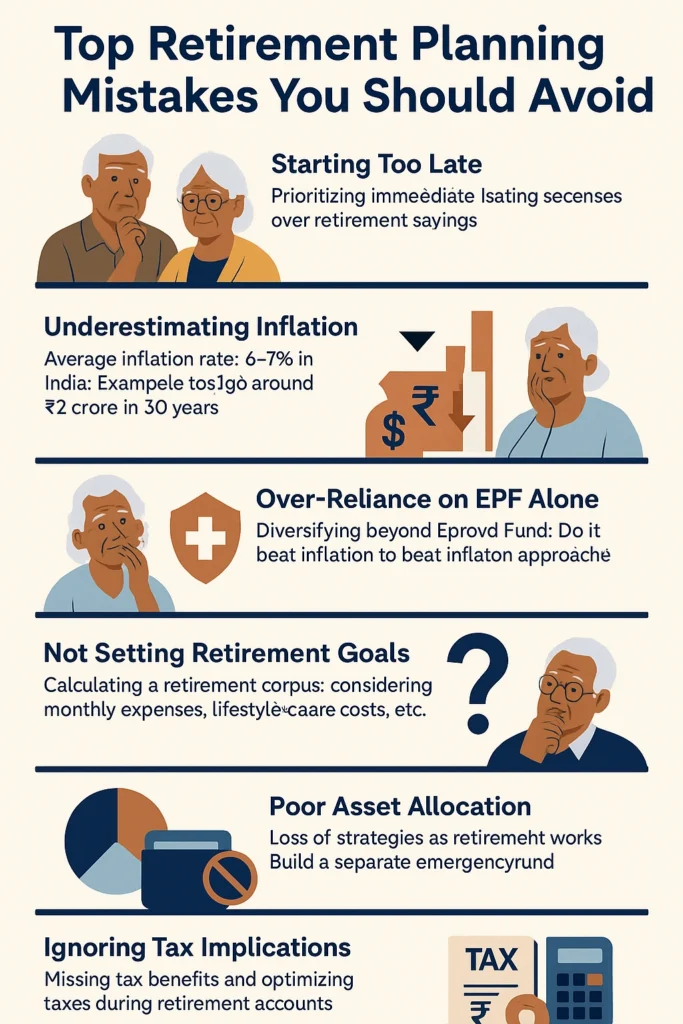

Starting Too Late – The Biggest Mistake of All

The Mistake: One of the most prevalent and damaging errors is delaying retirement planning. Many individuals, especially young earners, believe they have plenty of time to start saving later. They often prioritize immediate expenses like international travel, purchasing a new home, or upgrading their lifestyle over the long-term commitment of retirement savings.

Why It’s Costly: The power of compounding is an investor’s best friend, but it requires time to work its magic. Starting late drastically reduces the benefits of this exponential growth, forcing you to save much larger amounts closer to retirement to achieve the same financial goal. The difference in accumulated wealth between an early starter and a late starter can be staggering.

Let’s illustrate this with an example:

| Investor | Starting Age | Monthly Investment | Annual Return | Corpus by Age 60 (Approx.) |

|---|---|---|---|---|

| Ramesh | 25 | ₹25,000 | 10% | ₹9.57 crore |

| Suresh | 45 | ₹25,000 | 10% | ₹1.04 crore |

As you can see, Suresh, who started just 20 years later than Ramesh with the exact same monthly investment, accumulates only about 15% of Ramesh’s total savings by retirement age. This dramatic difference underscores the immense power of time in compounding.

The Solution: The most effective solution is to start early. Aim to invest at least 15-18% of your annual income in a diversified portfolio of equity instruments and bonds right from the beginning of your career. Even small amounts invested consistently in your twenties can lead to a significantly larger corpus than much larger contributions made closer to your retirement age. Make retirement savings a non-negotiable part of your monthly budget, just like any other essential expense.

Underestimating the Impact of Inflation

The Mistake: A common oversight in retirement planning is failing to factor in the insidious impact of inflation. Many investors mistakenly assume that today’s expenses will remain constant throughout their retirement years. This leads to calculating a retirement corpus that, while seemingly large, will have significantly diminished purchasing power in the future.

The Reality: India’s average inflation rate has historically hovered around 6-7%. This seemingly small percentage can have a massive erosive effect on your savings over decades.

Consider the following impact of a 6% annual inflation rate:

| Current Value / Expense | Time Horizon | Future Value / Expense (Approx. at 6% inflation) |

|---|---|---|

| ₹2 crore today | 30 years | Purchasing power of ₹31 lakh today |

| ₹50,000 monthly expense today | 30 years | ₹2.9 lakh monthly to maintain same lifestyle |

This means that if you plan for ₹2 crore based on today’s value, it will feel like having only ₹31 lakh in purchasing power after 30 years of inflation. Similarly, your current ₹50,000 monthly expenses could balloon to nearly ₹2.9 lakh per month to maintain the same lifestyle.

Also Read :- HOW INFLATION IMPACTS YOUR FINANCES & HOW TO PROTECT IT

The Solution: Always factor inflation into your retirement planning calculations. Use a realistic inflation rate (e.g., 6-7% for India) when projecting your future expenses and desired corpus. Crucially, choose investments that have the potential to beat inflation over the long term. Equity mutual funds, for instance, have historically provided returns that outpace inflation, unlike traditional fixed-income instruments. While the RBI’s inflation target range is 4-6%, it’s prudent to plan for the higher end or slightly above to be safe.

Ignoring Healthcare Expenses

The Mistake: Many individuals, especially as they approach or enter retirement, gravely underestimate the escalating costs of healthcare. As we age, our medical needs typically increase, and healthcare expenses can quickly deplete a retirement corpus if not properly planned for.

The Alarming Statistics: Healthcare inflation in India is significantly higher than overall inflation, averaging a staggering 10-15% annually. This rapid rise means that medical treatments in your 50s, 60s, and beyond can be incredibly expensive:

| Medical Procedure | Estimated Cost (₹ Lakhs) |

|---|---|

| Knee Replacement | 1.5 to 6 |

| Cancer Treatment | 10 to 20 |

| Bypass Surgery | 2 to 4 |

These figures represent single procedures and do not account for ongoing medication, diagnostic tests, or long-term care, which can add up significantly.

The Solution: Proactively invest in comprehensive health insurance that covers critical illnesses, hospitalization, and potentially long-term care. Experts suggest securing a health cover of at least ₹10 lakhs to adequately combat rising healthcare costs. It’s vital to purchase health insurance early in life, as premiums increase significantly with age, and pre-existing conditions can lead to exclusions or higher costs. Don’t rely solely on corporate health plans, as they often cease upon retirement.

Over-Reliance on EPF Alone

The Mistake: For many salaried individuals in India, the Employee Provident Fund (EPF) is their primary, and sometimes only, retirement savings vehicle. While EPF is a valuable and mandatory savings tool, over-reliance on it alone for a comfortable retirement is a common mistake.

Why It’s Insufficient: EPF typically provides stable but moderate returns, historically around 8-8.5% annually. While this is a decent fixed return, it may not be sufficient to consistently beat the higher rates of inflation over the long term, especially when considering healthcare inflation.

Let’s look at a hypothetical EPF corpus:

| Basic Annual Salary | Years of Service | Assumed EPF Interest | Approximate EPF Corpus by Retirement (Age 60) |

|---|---|---|---|

| ₹3 lakh | 30 | 8% | ₹70.7 lakh |

For a comfortable post-retirement life, especially considering rising costs, ₹70.7 lakh may prove to be inadequate.

The Solution: Diversify your retirement savings beyond just EPF. Supplement your EPF contributions by investing in other growth-oriented avenues that have the potential for higher, inflation-adjusted returns. Consider options like the National Pension System (NPS), equity mutual funds (through Systematic Investment Plans or SIPs), and other market-linked instruments. A well-rounded retirement portfolio should ideally include a mix of EPF, NPS, mutual funds, and other investment vehicles to ensure both stability and growth.

Also Read :- Top Tax-Free Investments for Retirees in India (2025 Edition)

Not Setting Clear Retirement Goals

The Mistake: Many people embark on their retirement savings journey without a clear destination in mind. They save diligently but without calculating exactly how much they’ll need for retirement, leading to either over saving (less common) or, more frequently, under saving.

The Problem: Without a specific financial target, it’s incredibly difficult to stay disciplined in your savings approach. You might not save enough, or you might withdraw funds prematurely, only to face a significant shortfall when your regular income stops and you enter retirement. This lack of a clear goal can lead to anxiety and financial insecurity later in life.

The Solution: Before you start saving, calculate your retirement corpus. This isn’t a one-time exercise but an ongoing process. When calculating, consider:

- Your current monthly expenses and how they might change in retirement.

- Your expected lifestyle changes (e.g., more travel, hobbies, or perhaps a simpler life).

- Your life expectancy (it’s prudent to plan for living until at least 80-85 years, or even longer).

- A realistic inflation rate that will erode your purchasing power.

- Anticipated healthcare costs (as discussed earlier).

- The need for a separate emergency fund.

You can use online retirement calculators as a starting point, but for personalized and comprehensive planning, it’s highly recommended to consult with a certified financial advisor. They can help you create a tailored roadmap that aligns with your unique circumstances and aspirations.

Poor Asset Allocation Strategy

The Mistake: Investors often make errors in their asset allocation strategy, either by being excessively conservative or overly aggressive.

- The Conservative Trap: Many prefer the perceived safety of fixed deposits (FDs) or other traditional debt instruments. However, FDs in India typically offer returns of around 6.5% before tax. When you factor in an average inflation rate of 7.25% (as seen historically), you are effectively losing money in real terms, meaning your savings are losing purchasing power.

- The Aggressive Trap: Conversely, some investors might put almost all their retirement savings into equities, chasing higher returns. While equities offer growth potential, research suggests that increasing equity allocation beyond 50% in a retirement portfolio, especially closer to retirement, can actually lead to worse outcomes due to sequence of returns risk. A significant market downturn early in retirement can severely deplete a portfolio from which withdrawals are being made.

The Solution: Adopt a balanced and age-appropriate asset allocation strategy. This involves diversifying your investments across different asset classes (equities, debt, gold, real estate) based on your age and risk profile:

| Career Stage | Age Group | Recommended Equity Allocation | Recommended Debt Allocation |

|---|---|---|---|

| Early Career | 20s-30s | 60-70% | 30-40% |

| Mid-Career | 40s-50s | 50-60% | 40-50% |

| Pre-Retirement | 50s-60s | 40-50% (gradually decreasing) | 50-60% (gradually increasing) |

This approach aims to capture growth potential in your younger years while gradually shifting towards capital preservation as you inch closer to retirement. Regular rebalancing is crucial to maintain your desired allocation.

Also Read :- 8 golden rules to SIP investing

Frequent Withdrawals from Retirement Funds

The Mistake: A significant error that can derail even a well-planned retirement is making frequent or premature withdrawals from dedicated retirement funds like EPF, PPF, or other pension accounts. These funds are designed for long-term growth and should ideally remain untouched until retirement.

The Impact: Every withdrawal from your retirement corpus leads to a direct erosion of your savings and, more importantly, a loss of the crucial compounding benefits on the withdrawn amount. The money taken out early misses out on years, or even decades, of potential growth, significantly reducing your final retirement nest egg.

The Solution:

- Build a separate emergency fund that covers 6-12 months of your essential expenses. This fund should be liquid and easily accessible, preventing the need to dip into your long-term retirement savings for unexpected events.

- For major expenses like children’s higher education, explore options like education loans instead of depleting your retirement savings.

- Avoid using retirement funds for other financial goals, such as buying a new car or funding a vacation. Keep your retirement savings sacrosanct.

Ignoring Tax Implications

The Mistake: Many individuals fail to optimize the tax benefits available for retirement planning or neglect to understand the tax implications during the withdrawal phase. This can lead to missed savings opportunities during your earning years and unexpected tax liabilities in retirement.

Missed Opportunities: India’s tax laws offer several incentives for retirement savings:

- EPF contributions qualify for deductions under Section 80C of the Income Tax Act.

- National Pension System (NPS) offers an additional deduction of ₹50,000 under Section 80CCD(1B), over and above the 80C limit.

- Senior Citizens’ Savings Scheme (SCSS), Public Provident Fund (PPF), and various annuity plans also come with distinct tax benefit.

The Solution: Take the time to understand the tax implications of different retirement products and strategically choose those that align with your financial goals and offer optimal tax savings. Furthermore, plan for tax-efficient withdrawal strategies during retirement to minimize your tax burden when you start drawing income. Consulting a tax professional can provide invaluable guidance here.

Also Read :- Is an SWP the Ideal Strategy for Managing Retirement Income?

Not Planning for Spouse’s Retirement Needs

The Mistake: Often, retirement planning focuses primarily on the main earner’s needs, neglecting the financial security of the spouse, especially considering that women typically have a longer life expectancy. This oversight can create significant financial strain if the primary earner passes away or if the spouse’s independent financial needs are not met.

The Statistics: According to PFRDA data, life expectancy at age 60 is approximately 17.4 years for males and 18.9 years for females. Given typical age gaps of 3-5 years between spouses, the surviving spouse might need financial support for an extended period.

The Solution: Plan retirement savings that will be adequate for both spouses and designed to last for the longer-lived partner. This might involve joint accounts, considering the spouse’s potential income (or lack thereof), and factoring in their specific healthcare needs. It’s also crucial to update nominees on all retirement accounts and ensure both spouses are well-versed in managing the retirement finances, especially in case of unforeseen circumstances.

Inadequate Withdrawal Strategy

The Mistake: Accumulating a large retirement corpus is only half the battle; the other half is having a clear plan for how to withdraw money during retirement. Without a well-thought-out withdrawal strategy, retirees might withdraw too aggressively, depleting their savings prematurely, or too conservatively, unnecessarily compromising their lifestyle.

The Challenge: The popular “4% withdrawal rule” from the US, which suggests withdrawing 4% of your portfolio value annually, may not work directly in India due to higher market volatility and different economic conditions. Research suggests a more conservative 3-3.5% withdrawal rate may be more appropriate for the Indian context to ensure longevity of funds.

The Solution:

- Develop a systematic withdrawal plan (SWP) for regular income from your mutual funds or other investment. This provides a steady cash flow while allowing the remaining corpus to grow.

- Consider the bucket strategy: Divide your retirement savings into different “buckets” based on when you’ll need the money – for example, short-term (1-2 years of expenses in liquid funds), medium-term (3-7 years in balanced funds), and long-term (10+ years in growth-oriented assets).

- Explore purchasing annuities from life insurance companies. While they might offer lower returns, they provide a guaranteed income stream for life, mitigating longevity risk.

Also Read :- From SIP to SWP: Your Path to Financial Freedom

Lifestyle Inflation and Debt in Retirement

The Mistake: Entering retirement with significant debt (like credit card debt, outstanding home loans, or personal loans) or maintaining an unsustainable lifestyle that depletes savings too quickly are critical errors.

The Problem: Debt payments can become a severe strain on a fixed retirement income, eating into funds meant for living expenses and leisure. Similarly, failing to adjust your lifestyle to a reduced income level can lead to your carefully built corpus running out prematurely.

The Solution:

- Prioritize paying off all debts, especially high-interest debt, before you retire. Aim for a debt-free retirement.

- Plan for lifestyle adjustments in retirement. This doesn’t necessarily mean a drastic downgrade, but a realistic assessment of your income and expenses.

- Avoid taking on new debt after age 50, as repayment can be challenging on a fixed income.

- Consider downsizing your home if necessary to reduce property taxes, maintenance costs, and potentially free up capital.

Key Takeaways for Indian Retirees

Building a secure retirement requires diligence and foresight. Here are the most crucial takeaways:

- Start Early: Time is your biggest asset. The power of compounding works best over long periods.

- Account for Inflation: Always plan for a realistic inflation rate (6-7% for India) when calculating your future retirement needs.

- Diversify Your Portfolio: Don’t rely on a single source of retirement income. Mix EPF, NPS, mutual funds, and other instruments.

- Plan for Healthcare: Healthcare costs are rising faster than general inflation. Adequate health insurance and a medical contingency fund are non-negotiable.

- Regular Reviews: Your financial situation and market conditions change. Review and adjust your retirement plan annually or when major life events occur.

- Professional Guidance: Consider consulting certified financial planners for personalized retirement strategies tailored to your unique circumstances.

- Emergency Fund: Maintain 6-12 months of expenses in liquid funds, separate from your retirement savings.

- Tax Optimization: Maximize tax benefits available for retirement planning while understanding withdrawal implications.

By diligently avoiding these common mistakes and implementing a well-thought-out retirement strategy, you can build a substantial corpus that ensures financial independence and peace of mind during your golden years. Remember, retirement planning is not just about accumulating wealth; it’s about creating a sustainable income stream that maintains your desired lifestyle throughout your entire retirement.

FAQs (Frequently Asked Questions)

- What is the biggest mistake in retirement planning? The biggest mistake is starting too late, as it significantly reduces the benefits of compounding, requiring much larger savings later to achieve the same retirement corpus.

- Why is inflation important in retirement planning for Indians? India’s high inflation rate (historically 6-7%) erodes purchasing power. Failing to account for it means your retirement savings will buy far less in the future than they do today.

- How much health insurance do I need for retirement in India? Given healthcare inflation of 10-15% annually, experts suggest a comprehensive health cover of at least ₹10 lakhs for retirees in India.

- Is EPF enough for retirement in India? No, relying solely on EPF is often insufficient. While EPF is a good start, its returns may not always beat inflation, necessitating diversification into other growth-oriented investments like NPS and mutual funds.

- What is a good asset allocation strategy for retirement planning? Asset allocation should be age-appropriate: higher equity (60-70%) in early career, balanced (50-60% equity) in mid-career, and gradually shifting to more debt (50-60%) closer to retirement.

- Why should I avoid early withdrawals from retirement funds? Early withdrawals from retirement funds like EPF or PPF erode your corpus and cause you to lose out on years of compounding benefits, significantly reducing your final retirement nest egg.

- What is a safe withdrawal rate for retirement in India? While the 4% rule is popular globally, research suggests a more conservative 3-3.5% withdrawal rate may be more appropriate for Indian market conditions to ensure your retirement corpus lasts.