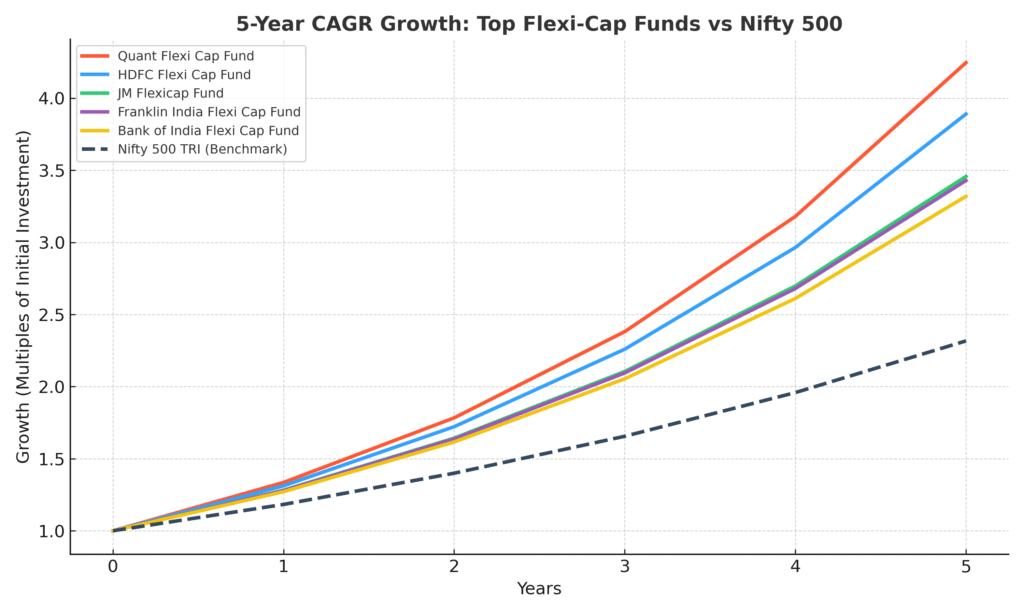

Don’t Miss Out! These 5 Flexi-Cap Funds Gave 300% Returns in Half a Decade

For investors in India, flexi-cap funds have been a goldmine in recent years. By offering fund managers the freedom to invest across large-cap, mid-cap, and small-cap stocks, these funds balance growth potential with risk management. And if you needed proof of their power, here it is: five standout flexi-cap mutual funds have delivered over 300% total returns in just five years, multiplying investor wealth more than three times.

Let’s break down the winners, their performance, and why flexi-cap funds deserve your attention right now.

The Top 5 Flexi-Cap Performers

| Fund Name | 5-Year CAGR (%) | Money Multiplier | Total Returns (%) |

|---|---|---|---|

| Quant Flexi Cap Fund | 33.54% | 4.25x | 325% |

| HDFC Flexi Cap Fund | 31.22% | 3.89x | 289% |

| JM Flexi cap Fund | 28.16% | 3.46x | 246% |

| Franklin India Flexi Cap Fund | 27.95% | 3.43x | 243% |

| Bank of India Flexi Cap Fund | 27.12% | 3.32x | 232% |

Why These Funds Outperformed

1. Dynamic Allocation Advantage

Unlike large-cap or mid-cap focused funds, flexi-cap funds can shift freely between market segments. This flexibility let managers grab opportunities across sectors and market sizes.

2. Skilled Fund Management

From Quant’s aggressive growth focus to HDFC’s disciplined strategy, expert fund managers made the right calls during volatile markets.

3. Consistent Risk Control

Even with stellar growth, these funds stayed diversified—spreading investments across industries and caps to reduce concentration risk.

Also Read :- How to Pick the Right Mutual Fund in India: A Simple Guide

Real-World Wealth Creation

To put the numbers into perspective:

- An investment of ₹1 lakh in Quant Flexi Cap Fund five years ago would now be worth over ₹4.25 lakhs.

- A monthly SIP of ₹10,000 in JM Flexicap Fund for 10 years would have grown to about ₹42.1 lakhs, compared to total contributions of just ₹12 lakhs.

- Even funds outside the top five, like Parag Parikh Flexi Cap, generated ₹38.3 lakhs over a similar SIP—showing the broader category strength.

Market Context

The flexi-cap category itself averaged 21.8% annual returns over the last five years, comfortably beating the broader market. This adaptability has allowed investors to weather downturns while riding growth cycles.

As of August 2025, flexi-cap funds also command strong investor trust, with heavy inflows and large AUM bases. For example, Parag Parikh Flexi Cap leads the pack with over ₹1.1 lakh crore in assets, while HDFC Flexi Cap follows closely.

Also Read :- Mutual Funds: Beyond Stocks and Bonds – Exploring Different Categories

Should You Invest?

If you’re looking for long-term wealth creation with flexibility, flexi-cap funds are worth serious consideration. They’re not risk-free—markets can swing—but their ability to balance between growth and stability makes them a strong core portfolio choice.

Bottom line: These funds have proven their worth by delivering extraordinary returns in just five years. Missing out on the next cycle could mean leaving serious wealth on the table.

Pro tip: Compare expense ratios, fund manager track records, and consistency before picking the right flexi-cap fund for your portfolio.

Why These Funds Stand Out

1. Quant Flexi Cap Fund: The Category Leader

Delivering an impressive 33.54% CAGR, this fund has outperformed the benchmark Nifty 500 TRI (18.3% CAGR over the same period). An investment of ₹1 lakh would have grown to nearly ₹4.25 lakhs in just 5 years. Its aggressive allocation strategy and active management style have made it the top performer.

2. HDFC Flexi Cap Fund: Scale with Discipline

Managing over ₹75,000 crores in AUM, HDFC’s flexi-cap offering clocked a 31.22% CAGR. With a diversified portfolio across large and mid-caps, it delivered nearly 3.9x growth in 5 years — proving scale doesn’t limit performance when backed by disciplined stock selection.

3. JM Flexicap Fund: A Dark Horse Performer

Though less popular than its peers, JM Flexicap surprised with a 28.16% CAGR, turning ₹1 lakh into over ₹3.46 lakhs. Its broad portfolio of 60+ stocks across market segments reduced risks while capturing growth opportunities.

Also Read :- Best Mutual Funds for 2025: A Simple Guide to Investing

4. Franklin India Flexi Cap Fund: Balanced and Consistent

This fund’s 27.95% CAGR reflects consistency rather than aggressive bets. Franklin’s approach of blending stable large-caps with promising mid/small-caps allowed it to deliver nearly 3.4x growth with relatively lower volatility.

5. Bank of India Flexi Cap Fund: The Underdog

With 27.12% CAGR, this fund isn’t just a safe bet but a solid wealth creator. In less than five years, it more than tripled investor money — a strong outcome for those who backed it early.

What Made These Funds Successful?

- Dynamic Market Cap Allocation: Unlike large-cap or mid-cap funds, flexi-cap funds can shift between market segments based on conditions. This flexibility was crucial in navigating volatility.

- Expert Fund Management: The managers behind these funds actively identified high-growth sectors like banking, IT, and manufacturing while managing risks.

- Diversification with Returns: Despite chasing growth, the funds maintained diversified portfolios to balance reward with stability.

Also Read :- Multi-Asset Allocation Funds: What They Are, Benefits, and Why You Should Consider Them

Investment Growth Example

A monthly SIP of ₹10,000 over 10 years in these top funds would have grown significantly:

- Quant Flexi Cap Fund: ~₹48.9 lakhs (against ₹12 lakh invested)

- JM Flexicap Fund: ~₹42.1 lakhs

- Parag Parikh Flexi Cap Fund (not in top 5 but notable): ~₹38.3 lakhs

This shows how consistent investing, combined with high-performing flexi-cap funds, can accelerate wealth creation.

Key Takeaway

The Top 5 Flexi-Cap Funds That Tripled Investor Money in Just 5 Years highlight how flexible allocation strategies and smart management can deliver extraordinary results. While past performance doesn’t guarantee future returns, these funds showcase the potential of flexi-cap investing as a long-term wealth creator.

FAQs (Frequently Asked Questions)

Q1. What are flexi-cap funds and how are they different from other mutual funds?

Flexi-cap funds are equity mutual funds that can invest across large-cap, mid-cap, and small-cap companies without restriction. Unlike large-cap funds that stick to big companies, flexi-cap funds give fund managers the flexibility to shift allocations depending on market conditions.

Q2. Which flexi-cap fund gave the highest 5-year return?

According to the latest data, Quant Flexi Cap Fund topped the list with a 5-year CAGR of 33.54%, multiplying investor wealth more than 4 times in just half a decade.

Q3. How much money would ₹1 lakh have grown into in these top-performing funds?

For example, ₹1 lakh invested in Quant Flexi Cap Fund five years ago would now be worth around ₹4.25 lakhs. Other funds in the list, like HDFC Flexi Cap and JM Flexi cap Fund, also tripled initial investments.

Q4. Are flexi-cap funds safe for long-term investors?

While flexi-cap funds carry equity market risks, they are considered relatively balanced because they diversify across market caps. For long-term investors with moderate risk appetite, they can be a strong wealth-creation tool.

Q5. Should I start a SIP in flexi-cap funds now?

Yes, starting a SIP can be a smart way to invest in flexi-cap funds. A ₹10,000 monthly SIP in top funds like Quant or JM Flexi cap would have generated over ₹40 lakhs in 10 years. However, investors should align SIPs with their financial goals and risk tolerance.

Disclaimer :- This article on top-performing flexi-cap funds is intended for educational and informational purposes only. It does not constitute financial, investment, or tax advice. All mutual fund investments are subject to market risks, including possible loss of principal. Past returns—such as 5-year CAGR or 300%+ gains—are not indicative of future performance. Investors are advised to conduct independent research or seek guidance from a certified financial advisor before making investment decisions.