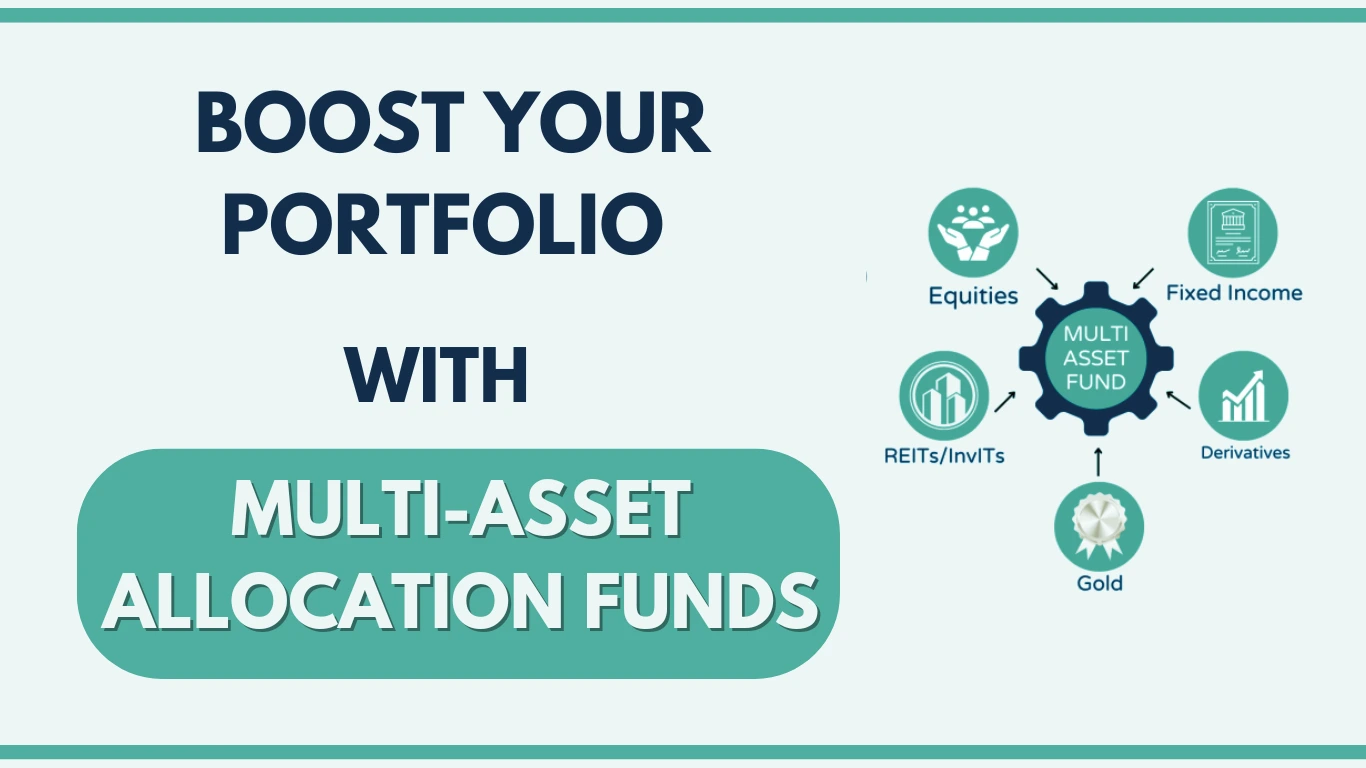

What Are Multi-Asset Allocation Funds?

Multi-asset allocation funds are like a one-stop solution for diversification. They allow you to invest in a mix of asset classes—such as stocks, bonds, gold, real estate, and even commodities—all with just one fund. This diversification spreads out the risk while aiming to give you steady returns.

Think of these funds as a financial balancing act: they aim to grow your wealth while keeping it stable, regardless of market ups and downs.

In recent years, these funds have shown great potential, with returns reaching as high as 50% in the past year and averaging around 16% over the last three years. If you prefer a balance between risk and reward, and want professionals to manage your investments, these funds could be worth exploring.

How Do Multi-Asset Allocation Funds Work?

Here’s the deal: instead of investing all your money in one type of asset (like stocks or bonds), multi-asset allocation funds spread your investment across at least three different asset classes. This rule is set by SEBI (Securities and Exchange Board of India) to ensure proper diversification.

Fund managers actively monitor these investments and adjust the mix depending on market trends. For example, if stocks are doing well, they might allocate more to equities. If the economy is uncertain, they might shift towards safer options like debt or gold.

What Do These Funds Invest In?

Multi-asset allocation funds typically invest in a combination of:

- Stocks (Equities): For long-term growth potential.

- Bonds (Debt): For stability and regular income.

- Gold: A safety net against inflation and market ups and downs.

- Real Estate: Through REITs (Real Estate Investment Trusts) or other securities.

- Commodities: Things like metals and agricultural goods.

- Alternative Investments: Unique assets like hedge funds or private equity.

On average, these funds divide their investments with around 60-65% in equities, 20-25% in debt instruments, and the rest in other asset classes, depending on market conditions.

What Makes Multi-Asset Allocation Funds Special?

These funds offer a ton of advantages that make them stand out:

- Diversification Your money is spread across different types of assets, reducing the risk of loss if one investment performs poorly.

- Risk Management A balanced mix of assets helps to protect your portfolio during tough market times.

- Professional Management Expert fund managers do all the hard work—monitoring, analyzing, and reallocating funds to maximize returns.

- Flexibility These funds adapt to changing market conditions, shifting focus between assets to capitalize on opportunities or reduce risks.

- Convenience Instead of juggling multiple investments yourself, you get diversification with just one fund.

- Balanced Risk-Return By combining growth-oriented assets (like stocks) with stable ones (like bonds), these funds aim for a steady balance of returns and safety.

- Automatic Rebalancing Fund managers regularly adjust the portfolio to keep it aligned with the investment strategy—no effort required on your part.

Are Multi-Asset Allocation Funds Worth Investing In?

Looking at their performance, these funds have delivered impressive returns:

- Up to 50% in the past year

- Average 16% over the last three years

- Around 19% over five years

However, keep in mind that past performance doesn’t guarantee future returns. Investments always carry some level of risk.

Things to Keep in Mind

Before jumping into multi-asset allocation funds, there are a few things you should consider:

- Expense Ratios These funds often come with higher costs due to the active management and diversified approach.

- Performance Fluctuations Returns can vary depending on how each asset class performs in the market.

- Complexity Understanding the allocation of multiple asset classes might seem a bit overwhelming.

- Control You won’t have direct control over how money is distributed across assets—this is managed by the fund.

How Are These Funds Taxed?

Taxation depends on how long you hold the fund and its equity exposure:

- Dividends: Taxed according to your income tax slab.

- Short-Term Gains: If held for less than three years, the profits are taxed as per your income tax rate.

- Long-Term Gains: Held for more than three years? You’ll be taxed at 20% with indexation benefits.

If the fund invests more than 65% in equities, it will follow equity fund taxation rules. Otherwise, it’s taxed like a debt fund.

Who Should Invest in Multi-Asset Allocation Funds?

These funds are ideal for:

- Investors who want a balance between risk and reward.

- Medium to long-term investors who prefer professional management.

- Anyone looking for a convenient way to diversify without managing multiple investments.

Final Thoughts

Multi-asset allocation funds offer an efficient way to diversify and manage risk. With investments spread across various asset classes and guided by professional management, these funds can be a smart addition to your portfolio.

While they’ve shown solid performance in recent years, it’s always important to weigh the potential risks, expenses, and tax implications before deciding to invest.

If you’re looking for a well-rounded investment option that balances growth and stability, multi-asset allocation funds might just be the perfect fit for your financial goals. Why not explore this option and see how it aligns with your investment strategy?

Also Read :- https://ipofront.in/understanding-mutual-fund-returns-calculation/