Mangal Electrical Industries Ltd IPO Analysis

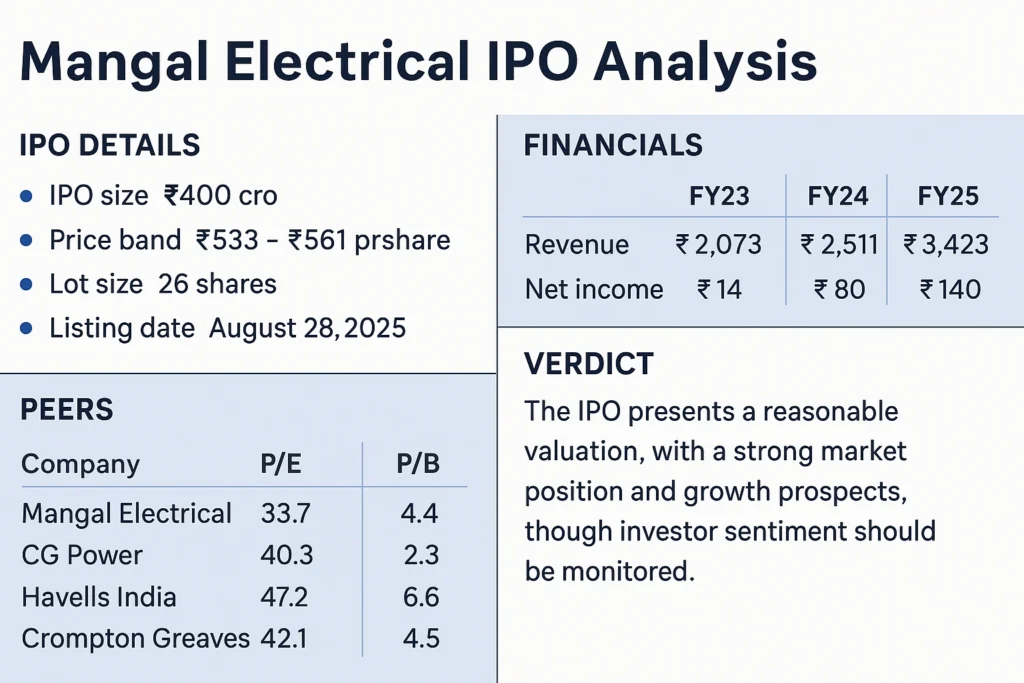

Mangal Electrical Industries Ltd is set to launch its ₹400 crore IPO from August 20–22, 2025, with a price band of ₹533–561 per share. This is a fresh issue only, with no offer-for-sale component, highlighting the company’s intent to raise funds for expansion, debt repayment, and working capital.

Mangal Electrical IPO will list on both BSE and NSE on August 28, 2025. The lot size is 26 shares, requiring a minimum investment of ₹14,586. At the upper price band, the company will command a market capitalization of ~₹1,550 crore.

Company Profile

Founded in 2008 and headquartered in Jaipur, Rajasthan, Mangal Electrical is a rising player in the power infrastructure sector. The company operates across three business segments:

- Transformer Components – CRGO slit coils, amorphous cores, wound cores, circuit breakers

- Transformer Manufacturing – distribution & power transformers (5 KVA to 10 MVA)

- EPC Services – turnkey substation projects and electrical commissioning

With five manufacturing plants, the company serves both government utilities (AVVNL, JVVNL, NTPC) and private clients (Siemens, Voltamp, Crompton Greaves). Exports extend to the USA, Middle East, and Europe, giving it global reach.

Also Read :- Shreeji Shipping Global IPO: Should you apply or avoid?

Mangal Electrical IPO Details

| Particulars | Details |

|---|---|

| IPO Size | ₹400 crore |

| Fresh Issue | ₹400 crore |

| Offer for Sale | Nil |

| Price Band | ₹533 – ₹561 |

| Face Value | ₹10 per share |

| Lot Size | 26 shares |

| Minimum Investment | ₹14,586 |

| Post-IPO Market Cap | ~₹1,550 crore |

| Subscription Dates | August 20 – 22, 2025 |

| Listing Date | August 28, 2025 |

| Exchanges | BSE, NSE |

| Purpose of Issue | Debt repayment, expansion, working capital, corporate use |

Financial History

| Financials (₹ Cr) | FY23 | FY24 | FY25 | CAGR (%) |

|---|---|---|---|---|

| Revenue | 402.5 | 498.0 | 607.4 | 24.4% |

| EBITDA | 37.4 | 42.5 | 90.6 | 56.8% |

| PAT (Profit After Tax) | 18.6 | 24.3 | 54.9 | 38.1% |

| Net Worth | 110.3 | 134.0 | 188.2 | – |

| Total Debt | 88.5 | 107.0 | 107.5 | – |

Key Ratios

| Ratios | FY23 | FY24 | FY25 |

|---|---|---|---|

| ROE (%) | 16.88 | 18.21 | 29.17 |

| ROCE (%) | 17.92 | 19.92 | 25.38 |

| EBITDA Margin (%) | 9.3 | 8.5 | 14.9 |

| PAT Margin (%) | 4.6 | 4.9 | 8.7 |

| Debt-to-Equity | 0.80 | 0.75 | 0.57 |

| EPS (₹) | 6.58 | 8.57 | 16.65 |

Peer Comparison

| Company | Revenue (₹ Cr) | PAT (₹ Cr) | EPS (₹) | P/E (x) | P/B (x) | ROE (%) | EBITDA Margin (%) |

|---|---|---|---|---|---|---|---|

| Mangal Electrical | 607.4 | 54.9 | 16.65 | 33.7 | 8.2 | 29.2 | 14.9 |

| Transformers & Rectifiers | 2,468 | 118.4 | 3.42 | 59.8 | 12.5 | 15.6 | 13.2 |

| Voltamp Transformers | 2,225 | 283.1 | 283.0 | 24.1 | 6.4 | 23.5 | 13.7 |

| Power Mech Projects | 4,500 | 259.0 | 88.6 | 18.9 | 5.2 | 19.2 | 12.4 |

| ABB India | 13,457 | 1,730 | 82.0 | 97.2 | 19.6 | 21.1 | 15.8 |

📌 Takeaway: Mangal Electrical offers strong ROE (29.2%) and margins, but trades at a premium P/E (33.7x) compared to peers like Voltamp and Power Mech.

Also Read :- Vikram Solar IPO: Apply or Avoid for Listing Gains?

Strengths

- Strong integrated model – backward integration + EPC services

- Established clientele in both govt. & private sector

- Growing export markets (USA, Middle East, Europe)

- Improved margins & profitability in FY25

- Direct beneficiary of government RDSS scheme

Risks

- Valuation premium vs peers

- Heavy dependence on government contracts (delays, payment cycles)

- Raw material volatility – copper, CRGO steel costs

- Smaller scale vs giants like ABB, Siemens

- Working capital intensive

Verdict – Should You Invest?

- Long-term Investors: Cautious Positive

- Good fundamentals, improving profitability, growth in exports & EPC

- Valuation on the higher side but justified by ROE strength

- Listing Gains: Limited Potential

- No strong grey market premium (GMP), valuations may cap listing upside

👉 Final Call: Selective Long-Term Buy. Investors with a long horizon and moderate risk appetite may consider subscribing.

FAQs (Frequently Asked Questions)

Q1. What are the IPO dates for Mangal Electrical Industries Ltd?

The IPO opens on August 20, 2025 and closes on August 22, 2025, with listing on August 28, 2025.

Q2. What is the price band and lot size of the IPO?

The IPO price band is ₹533–561 per share with a lot size of 26 shares (₹14,586 minimum investment).

Q3. How are Mangal Electrical’s financials?

The company reported FY25 revenue of ₹607 crore, PAT of ₹54.9 crore, and ROE of 29.2%, showing strong growth.

Q4. How does Mangal Electrical compare with peers like Voltamp and ABB?

Mangal has a smaller scale but stronger ROE and margins. However, it trades at a higher P/E of 33.7x.

Q5. Should investors apply for this IPO?

The IPO is attractive for long-term investors betting on power infra growth, but listing gains may be limited due to high valuations.

Disclaimer :-This is for educational purposes only. Views are from cited sources, not this publication. Investing involves risks, including potential loss of principal. Consult a financial advisor before deciding. Past performance doesn’t guarantee future results.