Index Fund Selection Made Simple: Your Guide to Smarter Investing in 2025

If you’ve been watching India’s mutual fund landscape lately, you’ve probably noticed one big trend—index funds are having their moment in the spotlight.

With the AUM (Assets Under Management) for passive funds like index mutual funds surging past ₹2.5 lakh crore in 2025, retail investors are waking up to the magic of market-matching returns with minimal fees. And it’s not just the big players anymore—almost every AMC (Asset Management Company) in India is now offering a bouquet of index funds, from large-cap trackers to mid-cap marvels and even smart-beta variants.

But with all this choice comes a big question: How do you pick the right index fund?

Let’s break it down together.

🧠 First, What Exactly Is an Index Fund?

Think of an index fund as a mirror—it reflects the performance of a specific stock market index. So, if you invest in a Nifty 50 index fund, your money moves in sync with the 50 largest companies listed on the National Stock Exchange.

Unlike actively managed mutual funds where fund managers decide what to buy and sell, index funds are passive. They just replicate the index. No guesswork. No stock-picking. No ego.

And guess what? That “do nothing” strategy often beats the flashy active ones over time. Lower costs, no churn, and a long-term approach—what’s not to love?

Also Read :- https://ipofront.in/gold-etf-vs-gold-mutual-fund/

📈 Why Index Funds Are Gaining Traction in India (2025 Edition)

Here’s a quick look at why index funds are exploding in popularity in India:

- ✅ Massive AUM Growth: Index fund AUM has crossed ₹2.5 lakh crore in 2025, up from just ₹1.5 lakh crore two years ago.

- ✅ SEBI’s Push for Transparency: The regulator has been encouraging passive investing and even nudging EPFO to allocate more towards index funds.

- ✅ Investor Education: Platforms like Zerodha, Groww, and ET Money have simplified fund discovery and comparison.

- ✅ More Choices: From SBI and HDFC to newer players like Navi and WhiteOak, everyone’s launching index funds now—some AMCs even have 10+ passive fund options!

So clearly, index investing is no longer just for finance nerds—it’s mainstream, and it’s here to stay.

Also Read :- https://ipofront.in/8-4-3-rule-in-mutual-funds-to-build-1-crore/

🧭 Step-by-Step Guide to Picking the Right Index Fund

Now that we’re sold on the idea, let’s figure out how to select the right index fund for you.

1. 🎯 Match the Index to Your Goal

Not all indices are created equal. Some are broad-based (like Nifty 500), others are niche (like Nifty IT). Here’s how to choose:

| Index Type | Best For |

|---|---|

| Nifty 50 / Sensex | Beginners, stable large-cap exposure |

| Nifty Next 50 | Slightly higher risk-return profile |

| Nifty Midcap 150 | Growth-oriented investors |

| Nifty Smallcap 250 | Aggressive investors with high risk tolerance |

| Nifty 100 Equal Weight | Diversification fans |

| International Index Funds (S&P 500) | Global exposure seekers |

Example: If you’re 30 years old and investing for retirement, a mix of Nifty 50 (60%) + Nifty Midcap 150 (30%) + S&P 500 (10%) could be a great long-term combo.

2. 💰 Check the Expense Ratio

The golden rule? Lower is better.

Even a 0.10% difference in expense ratio can mean lakhs of rupees over 20–30 years. Most good index funds in India charge between 0.10% to 0.25%.

Quick Comparison (2025 Data):

- ICICI Prudential Nifty 50 Index Fund – 0.20%

- Motilal Oswal Nifty 500 Index Fund – 0.25%

- Navi Nifty 50 Index Fund – 0.13% (one of the lowest in the industry)

A difference of 0.12% in cost may sound tiny now, but it could cost you ₹2–4 lakh in long-term wealth creation on a ₹10 lakh SIP over 20 years.

Also Read :- https://ipofront.in/avoid-these-5-mistakes-to-maximize-your-mutual-fund-profits/

3. 📉 Mind the Tracking Error

This metric tells you how well a fund tracks its index. Lower tracking error = better execution.

Look for funds with tracking error below 0.5%. Anything above 1% is a red flag unless it’s a niche or illiquid index.

Real-Life Example:

- HDFC Nifty 50 Index Fund: ~0.3% tracking error (very efficient)

- Motilal Oswal Nifty Small Cap 250 Index Fund: ~1.2% (due to low liquidity in small-cap stocks)

When comparing two funds tracking the same index, always pick the one with the lower tracking error.

4. 💦 Consider Liquidity and AUM

Low AUM = risk of fund closure or poor tracking.

Choose funds with at least ₹500 crore in AUM. For ETFs, check trading volume and bid-ask spread.

Why It Matters: An illiquid ETF can cost you money during buying/selling. A fund with low AUM might not be sustainable in the long run.

Top AUM Index Funds in India (2025):

- UTI Nifty 50 Index Fund – ₹8,000+ crore

- SBI Nifty 50 ETF – ₹40,000+ crore

- HDFC Nifty Next 50 Index Fund – ₹3,500+ crore

Also Read :- https://ipofront.in/understanding-mutual-fund-returns-calculation/

5. 🧾 Think About Taxes

While index funds are tax-efficient due to low turnover, ETFs often score even better due to “in-kind redemption” which avoids capital gains until you sell.

What to Remember:

- Less than 1 year: 15% STCG tax

- More than 1 year: 10% LTCG over ₹1 lakh

- Opt for Direct Plans over Regular Plans to avoid commission cuts

🧪 Pro Tips for Smarter Index Fund Investing

Here are some extra nuggets to make you a pro:

🔍 Look at the Index Methodology

Prefer market-cap-weighted indices over price-weighted ones. Avoid exotic indices unless you understand them.

📊 Avoid Overlapping Holdings

If you’re already invested in a Nifty 50 fund, adding Sensex or Nifty 100 might give you similar exposure. Diversify wisely.

📈 Rebalance Yearly

Markets move, and so does your asset allocation. Rebalance every 12 months to stay aligned with your goals and risk profile.

Also Read :- https://ipofront.in/gold-etf-vs-gold-mutual-fund/

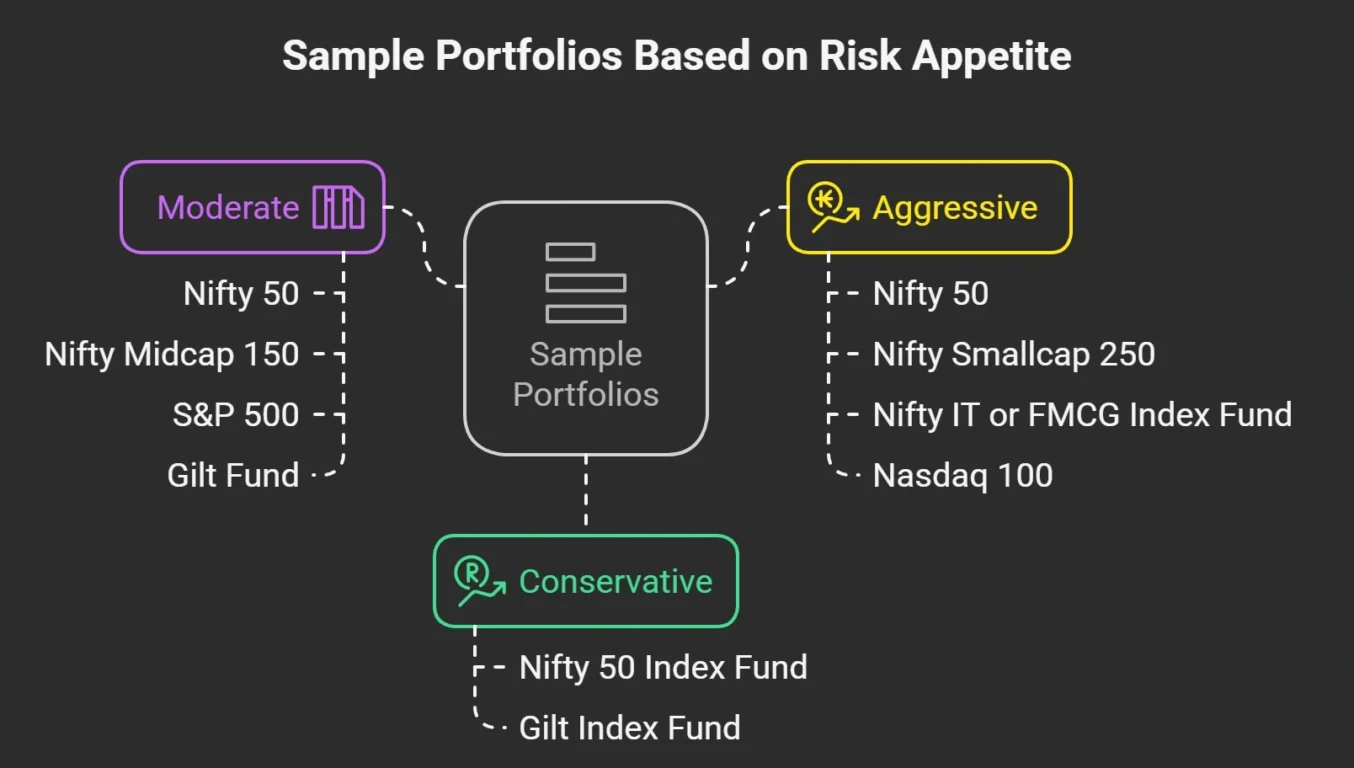

🧱 Sample Portfolios Based on Risk Appetite

✅ Conservative

- 70%: Nifty 50 Index Fund

- 30%: Gilt Index Fund (CRISIL IBX Gilt)

🟡 Moderate

- 50%: Nifty 50

- 20%: Nifty Midcap 150

- 20%: S&P 500

- 10%: Gilt Fund

🔴 Aggressive

- 40%: Nifty 50

- 30%: Nifty Small-cap 250

- 20%: Nifty IT or FMCG Index Fund

- 10%: Nasdaq 100

Portfolios Based on Risk Appetite

🎯 Final Thoughts: Simplicity Is Strength

Index investing isn’t about chasing returns. It’s about capturing the market—efficiently, affordably, and consistently.

With over 60+ index fund options now available in India from 20+ fund houses, the buffet is bigger than ever. But don’t let that overwhelm you.

Stick to the fundamentals:

✔ Choose the right index

✔ Prioritize low costs

✔ Watch tracking error

✔ Stay consistent

And remember: Time in the market always beats timing the market.

So go ahead—pick your index fund, start that SIP, and let compounding do the rest.

🙋♂️ FAQs

Q1. What is the best index fund in India in 2025?

There’s no one-size-fits-all. Top choices include UTI Nifty 50 Index Fund, HDFC Nifty Next 50, and Motilal Oswal Nifty Midcap 150. Choose based on your goals and risk tolerance.

Q2. Are index funds safer than other mutual funds?

They carry market risk but are diversified and transparent, making them a lower-cost, lower-churn alternative to active funds.

Q3. Can I lose money in an index fund?

Yes, during market downturns. But over long periods, index funds typically grow in line with the economy.

Q4. How much should I invest in index funds?

Aim for 30–70% of your equity allocation depending on your comfort with market volatility.

Q5. Are index funds better than ETFs?

For most beginners, index mutual funds are simpler. ETFs offer tax advantages and real-time trading but require demat accounts

Useful Links :-

Index Funds – List of Best Index Funds to Invest in India

Decoded: How you should choose the best index fund for wealth creation | Personal Finance – Business Standard

Which Index Fund Has the Lowest Tracking Error?

Market Makers Explained – Key Role in Trading

The Best Index Funds and How to Start Investing – NerdWallet