How to Pick the Right Mutual Fund

How to Pick the Right Mutual Fund in India: A Simple Guide

Introduction: Stressed Out? You’re Not the Only One!

Have you ever looked at the vast array of mutual funds and felt completely lost? You’re not the only one! Choosing the right mutual fund might seem intimidating, but it doesn’t have to be. In this guide, we’ll break the process into easy-to-follow steps, helping you select funds that align with your goals and comfort level.

Understanding Your “Why”: What Are You Saving For?

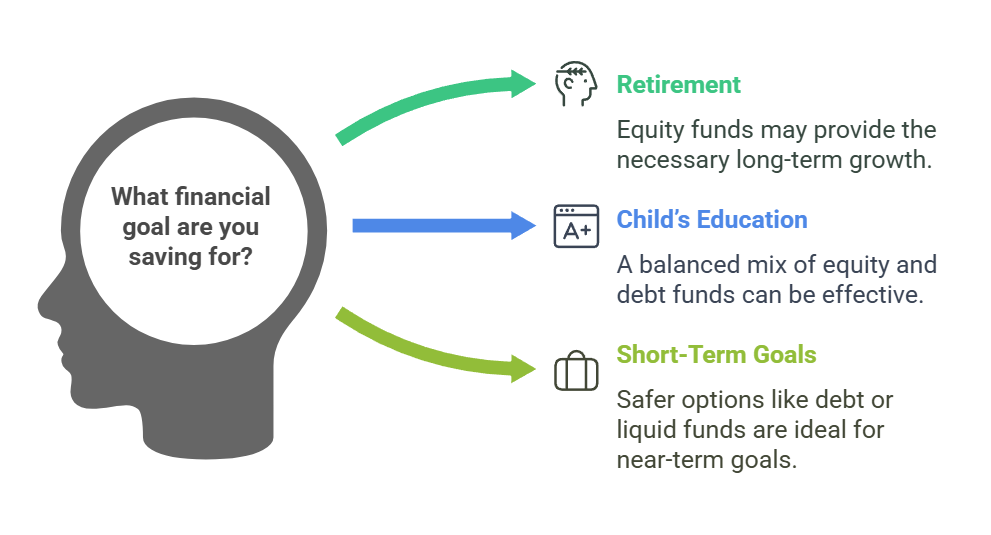

Before diving into fund options, take a moment to reflect: Why are you saving? Your financial goals will serve as your roadmap.

- Retirement: If you’re thinking long-term, equity funds may provide the growth you need.

- Child’s Education: A balanced mix of equity and debt funds can be a smart approach.

- Short-Term Goals (like a vacation): Safer options such as debt funds or liquid funds are ideal for goals within a year or two.

Key Takeaway: Your goals dictate the type of mutual fund you should choose.

Knowing Your Risk Appetite: Are You a Daredevil or a Cautious Driver?

Investing is like a journey. Do you crave adventure or prefer a smooth, predictable path? Knowing your risk tolerance helps narrow your options.

- High Risk Appetite: Comfortable with market ups and downs? Equity funds, including small-cap funds, might suit you.

- Moderate Risk Tolerance: Looking for balance? Hybrid funds that combine equity and debt are a good choice.

- Low Risk Appetite: Prefer stability? Debt funds, which focus on bonds, can meet your needs.

Pro Tip: Understanding your comfort level with risk ensures a more enjoyable investing experience.

Fund Selection: A Quick Tour

Here’s a snapshot of the most common mutual fund types:

Equity Funds

Primarily invest in stocks, offering higher growth potential with higher risk.

- Large-cap Funds: Focus on well-established companies (e.g., Reliance, TCS).

- Mid-cap Funds: Invest in mid-sized companies, balancing growth and stability.

- Small-cap Funds: Target smaller companies for higher potential growth but come with greater volatility.

Debt Funds

Invest in bonds and debt instruments, prioritizing stability over high returns.

- Short-term Debt Funds: Suitable for goals within 1-3 years.

- Long-term Debt Funds: Ideal for those looking for steady returns over a longer horizon.

Hybrid Funds

Combine equity and debt to offer a balanced approach.

- Balanced Funds: A mix of stocks and bonds, ideal for first-time investors seeking diversification.

Key Insight: The right type of fund depends on your investment horizon and risk tolerance.

Also Read:-https://ipofront.in/mutual-funds-beyond-stocks-and-bonds-exploring-different-categories/

Finding the Right Fit: Tips & Tricks

Finding the perfect mutual fund doesn’t have to be complicated. Here are some actionable tips:

- Use Online Tools: Comparison tools and apps help analyse performance, risk, and expense ratios.

- Read Fund Documents: Always check the scheme’s objectives, risks, and expenses.

- Assess Past Performance: While not a guarantee, past performance provides insights into how a fund reacts to market conditions.

- Decide Your Investment Style: Do you prefer active management with a fund manager picking stocks, or passive index funds tracking a market index?

Tip: Choose funds that align with your financial goals and preferences.

Staying on Track: Riding the Investment Rollercoaster

Investing is a journey, and staying disciplined is crucial. Here’s how to ensure you stay on track:

- Review Your Portfolio Regularly: Life changes, and so should your investments. Check your portfolio at least once a year.

- Rebalance Your Investments: Over time, your asset allocation may drift. Rebalancing ensures it matches your original plan.

- Don’t Panic During Market Swings: Markets fluctuate—it’s part of the process. Stick to your long-term plan instead of reacting impulsively.

Reminder: Patience and consistency are key to reaping the rewards of mutual fund investments.

Also Read:- https://ipofront.in/long-term-wealth-creation-sip-or-lumpsum/

Conclusion: Your Journey to Financial Freedom Starts Here

Choosing the right mutual fund might seem overwhelming at first, but with a clear understanding of your goals, risk tolerance, and fund options, the process becomes simpler. Start small, stay informed, and seek advice from financial professionals if needed.

Take Action Today: Begin your investment journey by exploring mutual funds that fit your goals. The sooner you start, the more time your money has to grow.

Useful Links and Resources

Here are some links to help you research and compare mutual funds:

- AMFI – Association of Mutual Funds in India

- Moneycontrol Mutual Funds

- Value Research

- Morningstar India

Disclaimer: This guide is for informational purposes only and does not constitute financial advice. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully and consult with a financial advisor before making investment decisions.