Ganga Bath Fittings IPO Listing Day Performance: A Comprehensive Analysis

The Ganga Bath Fittings IPO made its debut on the NSE SME platform on June 11, 2025, defying expectations amid lukewarm market sentiment and a low grey market premium (GMP). Surprising many, the IPO listed at a strong 20.4% premium, reflecting positive investor response. As a key player in the bathroom accessories manufacturing segment, Ganga Bath Fittings Limited’s listing day performance sheds light on current SME IPO trends and market dynamics. This blog dives deep into the IPO details, listing outcome, financial highlights, and what lies ahead for the company.

IPO Overview

Issue Details

- IPO Size: ₹32.65 crore

- Type: Fresh issue of 66.63 lakh equity shares

- Price Band: ₹46 – ₹49 per share

- Final Issue Price: ₹49

- Lot Size: 3,000 shares

- Minimum Investment (Retail): ₹1,47,000

The IPO did not include any offer-for-sale component, signalling that promoters are aiming to raise fresh capital for business expansion rather than exiting their stake.

Also Read :- https://ipofront.in/n-r-vandana-tex-industries-ipo-listing-day-performance-analysis/

Subscription Status

Ganga Bath Fittings’ IPO saw mixed demand from different investor categories. Here’s a snapshot of the subscription data:

| Category | Subscription (x) | Status |

|---|---|---|

| Retail Investors | 2.55x | Oversubscribed |

| Qualified Institutional Buyers (QIB) | 2.22x | Oversubscribed |

| Non-Institutional Investors (NII) | 0.73x | Undersubscribed |

| Total | 1.64x | Moderate Response |

The strong retail and institutional interest helped the IPO close above one time, though high-net-worth investors appeared cautious.

Listing Day Performance

Opening and Closing Prices

- Listing Date: June 11, 2025

- Issue Price: ₹49

- Listing Price: ₹59 (20.41% premium)

- Closing Price: ₹56.05 (14.39% above issue price)

Despite concerns about weak GMP before listing, Ganga Bath Fittings listed well above expectations. However, the share hit the lower circuit of 5% soon after listing, indicating profit booking and speculative activity.

Also Read :- https://ipofront.in/scoda-tubes-ipo-listing-performance-analysis-2025/

Intraday Volatility

- High: ₹59.00

- Low: ₹56.05

- Circuit Limit Hit: Lower (5%)

- Closing Premium: 14.39%

The quick shift from the opening high to the lower circuit suggests that short-term investors booked profits early, putting pressure on the share price.

Trading Volume

On listing day, over 15.36 lakh shares were traded, reflecting active market participation. This level of volume highlights both investor interest and the speculative nature of SME listings.

Company Profile

Business Model

Ganga Bath Fittings Limited manufactures a wide range of bathroom accessories under multiple brands such as Ganga, Glimpse, Stepian, and Tora. The company’s product portfolio includes:

- CP taps

- Showers

- PTMT taps

- ABS health faucets

- Stainless steel vanities

It operates across three major production units located in Shapar-Veraval, Gujarat.

Manufacturing Units

| Unit | Specialization | Product Count |

|---|---|---|

| GI Unit | CP taps and vanities | 250 SKUs |

| GBS Unit | Stainless steel showers | 32 SKUs |

| GPI Unit | ABS/PTMT fittings | 150 SKUs |

All facilities are ISO 9001:2015 certified, showing the company’s focus on quality management.

Distribution Network

With over 2,500 distributors across India, Ganga Bath Fittings has a well-established sales network. It caters to residential, commercial, and institutional clients, ensuring nationwide reach and repeat demand.

Financial Highlights

Revenue and Profit Trends

| Period | Revenue (₹ Cr) | Net Profit (₹ Cr) |

|---|---|---|

| FY 2023 | 12.18 | 0.09 |

| FY 2024 | 13.58 | 0.59 |

| 9M FY2025 | 22.46 | 3.61 |

The company recorded impressive growth in both revenue and profitability in the first nine months of FY2025, indicating strong operational efficiency.

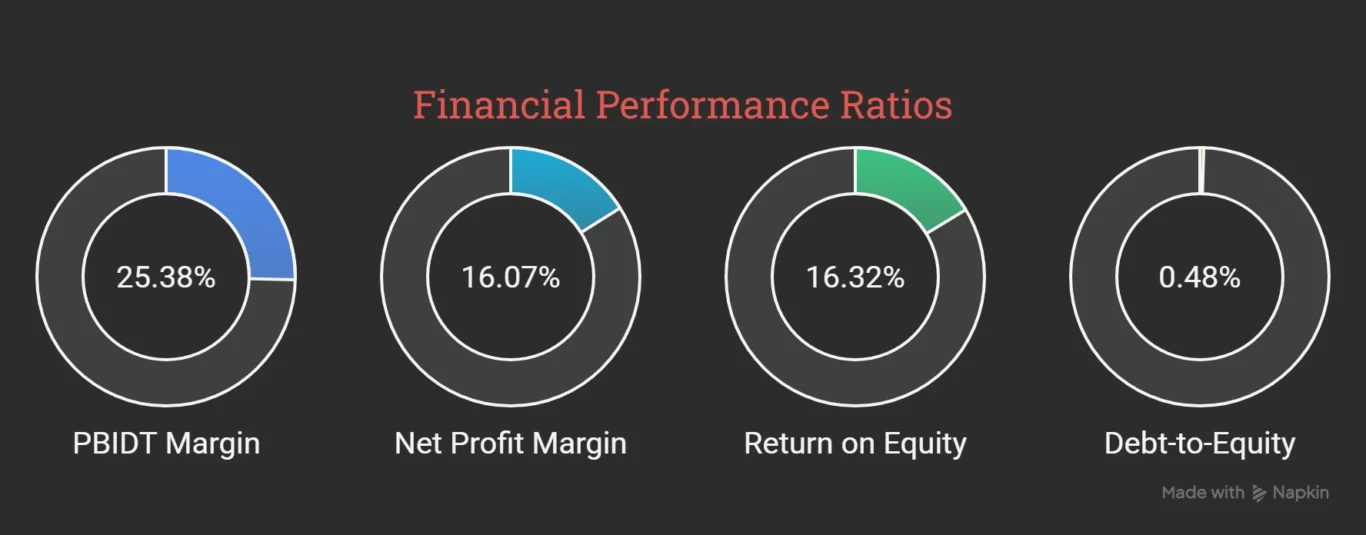

Key Ratios

- PBIDT Margin: 25.38%

- Net Profit Margin: 16.07%

- Return on Equity: 16.32%

- Debt-to-Equity: 0.48

These metrics indicate a healthy financial position with low leverage and strong profitability.

IPO Proceeds Utilization

The ₹32.65 crore raised will be used for the following purposes:

| Use Case | Amount (₹ Cr) | Percentage |

|---|---|---|

| Machinery & Equipment | 20.13 | 61.7% |

| Debt Repayment | 5.33 | 16.3% |

| Working Capital | 2.70 | 8.3% |

| General Corporate Purposes | 4.49 | 13.7% |

The major allocation towards capital expenditure aligns with the company’s growth strategy of expanding production capacity.

Industry Outlook

India’s sanitaryware and bathroom fittings sector is experiencing steady growth driven by:

- Real estate development

- Urbanization

- Government schemes like Swachh Bharat

- Rise in disposable incomes and lifestyle upgrades

However, the industry is fragmented, and competition from both domestic and international brands remains high.

Also Read :- https://ipofront.in/astonea-labs-ipo-listing-performance-analysis/

SME IPO Market Trends in 2025

As of mid-2025, the Indian SME IPO market has witnessed:

- 74 IPOs listed

- ₹3,229 crore raised

- 50 companies delivered listing gains

- 24 companies listed below issue price

Ganga Bath Fittings joins the list of SME companies that delivered positive listing returns, reflecting healthy investor interest despite volatility.

Investment Outlook

Positives

- Product Diversification: Wide variety of bathroom fittings

- Market Presence: Strong pan-India distribution

- Growth Strategy: Focused capex through IPO funds

- Financial Strength: Improving revenue and margins

Risks

- Industry Competition: Fragmented market with price sensitivity

- Valuation: Listing valuation relatively high for SME scale

- Volatility: Listing-day circuit hit raises short-term concerns

- Sustainability: Needs consistent demand to sustain recent profitability

Also Read :- https://ipofront.in/blue-water-logistics-ipo-listing-performance/

Conclusion

Ganga Bath Fittings Limited had a solid IPO debut with a 20.4% listing premium, despite limited pre-listing hype. The stock’s closing gain of 14.39% reflects positive sentiment tempered by market volatility.

With strong fundamentals, a wide product portfolio, and strategic use of IPO proceeds, the company is well-positioned for long-term growth. However, as with most SME stocks, short-term investors should be cautious due to low liquidity and high volatility.

Investors seeking exposure to the growing home improvement and fittings sector may consider Ganga Bath Fittings as a long-term opportunity, subject to appropriate risk management and portfolio diversification.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a SEBI-registered advisor before making any investment decisions.