Standard Glass Lining IPO: Should You Hold or Book Profits?

Standard Glass Lining IPO: Should You Hold or Book Profits?

The Indian stock market has been buzzing with activity, and the Standard Glass Lining IPO has been the talk of the town. If you were one of the fortunate investors who secured an allotment, congratulations! The IPO has not only made a stellar debut but also sparked discussions about its long-term prospects.

So, what’s next? Should you book your profits or hold on for the long haul? Let’s analyse the company, its IPO details, and its listing day performance before arriving at an informed decision.

A Quick Introduction to Standard Glass Lining Technology Limited

Founded in 2012, Standard Glass Lining Technology Limited is a leading manufacturer of glass-lined engineering equipment. These specialized products are essential for industries like pharmaceuticals and chemicals, where contamination-free environments are critical.

The company’s expertise lies in delivering end-to-end solutions—from design and manufacturing to installation and commissioning. With marquee clients such as Aurobindo Pharma and Cadila Pharmaceuticals, Standard Glass Lining is among India’s top five specialized engineering equipment manufacturers by revenue (FY24).

This robust foundation gives the company a significant edge in a niche but rapidly growing market.

Also Read :- https://ipofront.in/indo-farm-shares-jump-20-after-market-listing/

Breaking Down the IPO

The Standard Glass Lining IPO, which opened for subscription from January 6 to January 8, 2025, was met with enthusiastic participation from retail investors, institutional buyers, and HNIs alike.

Key Details of the IPO

- Issue Size: ₹410.05 crore

- Fresh Issue: ₹210 crore (aimed at reducing debt and funding machinery purchases)

- Offer for Sale (OFS): ₹200.05 crore (providing an exit route for existing shareholders)

- Price Band: ₹133 to ₹140 per share

- Lot Size: 107 shares per lot, requiring a minimum investment of ₹14,980 at the upper price band.

Subscription Numbers

The IPO witnessed overwhelming demand, with subscriptions being oversubscribed multiple times across all categories:

- Retail Investors: Oversubscribed by over 15 times.

- Qualified Institutional Buyers (QIBs): Oversubscribed by 27 times.

- High Net Worth Individuals (HNIs): Oversubscribed by 40 times.

Clearly, the market was highly optimistic about the company’s growth potential, and the frenzy was justified by its stellar listing.

Listing Day Performance: A Grand Debut

Standard Glass Lining’s shares debuted on January 13, 2025, with a bang. The stock opened at ₹188, delivering a 26% premium over its IPO price of ₹140. This performance not only reflected strong investor confidence but also reinforced the company’s position as a promising player in the engineering sector.

Key Takeaways from Listing Day

- High Volume Trading: The stock saw robust trading activity throughout the day, with significant interest from institutional and retail investors.

- Price Movement: Despite opening at a premium, the stock remained stable, signalling strong demand and limited selling pressure from early investors.

- Market Sentiment: Analysts and market participants were optimistic about the company’s ability to capitalize on the growing demand for glass-lined equipment.

If you were one of the lucky investors who secured an allotment, your portfolio likely saw a significant bump in value on Day 1. But what now? Should you lock in your profits or hold for the long term?

Should You Hold or Book Profits?

Here’s the million-dollar question: Is it time to exit or stick around for more gains? Let’s weigh the pros and cons.

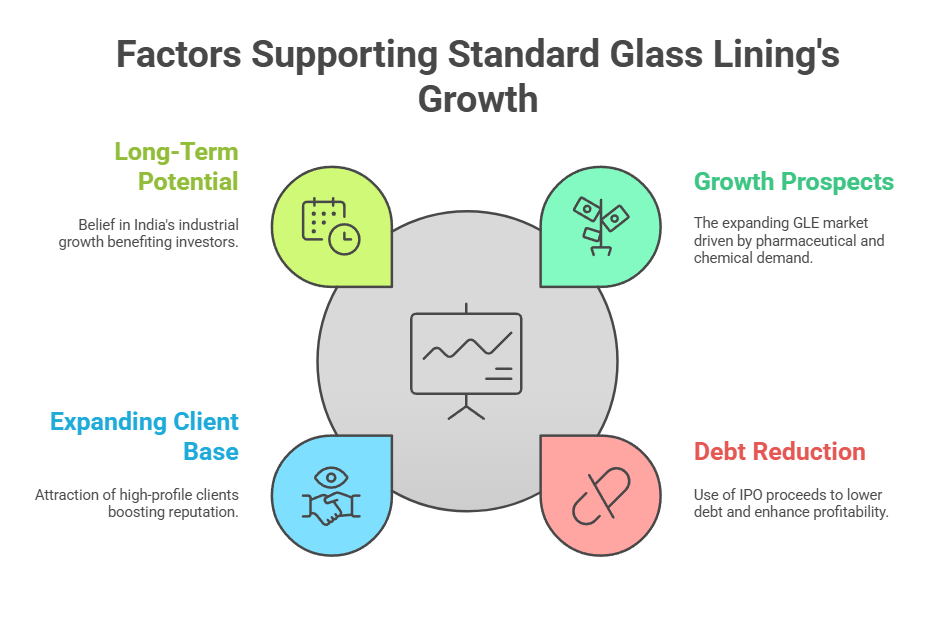

Why You Should Consider Holding

- Strong Growth Prospects:

The glass-lined equipment (GLE) market is poised for sustained growth, thanks to rising demand in the pharmaceutical and chemical sectors. With India emerging as a global pharma hub, companies like Standard Glass Lining are well-positioned to ride this wave. - Debt Reduction:

The fresh issue proceeds from the IPO will help the company reduce its debt burden, strengthening its financial position and improving profitability. - Expanding Client Base:

With marquee clients already on board, the company’s reputation and industry standing make it likely to attract more high-profile customers in the future. - Long-Term Potential:

If you believe in the growth story of India’s industrial and manufacturing sectors, holding onto Standard Glass Lining shares could prove rewarding over the next 3–5 years.

Standard Glass Lining IPO

Why You Might Want to Book Profits

- Short-Term Volatility:

IPO stocks often experience high volatility in the weeks following their listing. If the stock has already delivered a significant return on listing day, booking profits could be a prudent move. - Client Concentration Risk:

A significant portion of the company’s revenue comes from a limited number of clients. Any disruption in these relationships could impact the company’s financials. - Valuation Concerns:

After a 26% premium listing, the stock may already be trading at a high valuation. If you’re wary of overpaying, exiting at current levels could be a smart choice.

Also Read :- https://ipofront.in/parmeshwar-metal-share-38-surge-on-debut/

What Do the Experts Say?

Market analysts have mixed opinions about whether to hold or sell:

- Bullish Analysts: They highlight the company’s strong fundamentals, debt reduction plans, and growth potential in a niche market as reasons to hold for the long term.

- Cautious Analysts: They suggest booking profits if the stock continues to climb rapidly, citing valuation concerns and potential volatility.

How to Decide What’s Best for You

Ultimately, the decision to hold or sell depends on your individual investment strategy, financial goals, and risk appetite. Here are a few pointers to help you decide:

Hold If:

- You’re a long-term investor with a 3–5 year horizon.

- You believe in the company’s growth story and are willing to weather short-term market fluctuations.

- You’re not in immediate need of the funds invested.

Sell If:

- You’re a short-term trader looking to lock in quick profits.

- The stock price has surpassed your target valuation.

- You’re uncomfortable with the risks associated with client concentration and market volatility.

Final Thoughts

The Standard Glass Lining IPO has been an exciting journey so far, from oversubscription to a stellar listing day performance. Whether you choose to hold or book profits, the IPO has already proven to be a rewarding investment for those who secured allotments.

For long-term investors, the company’s growth potential, debt reduction plans, and strong market position make it an intriguing hold. For short-term traders, the listing day premium offers an excellent opportunity to cash in.

Whichever path you choose, the key is to make an informed decision that aligns with your financial goals. And as always, consult with a financial advisor if you’re unsure about your next move.

Happy investing!

Useful Links

Want to dive deeper into Standard Glass Lining’s IPO and market performance? Check out these helpful resources: