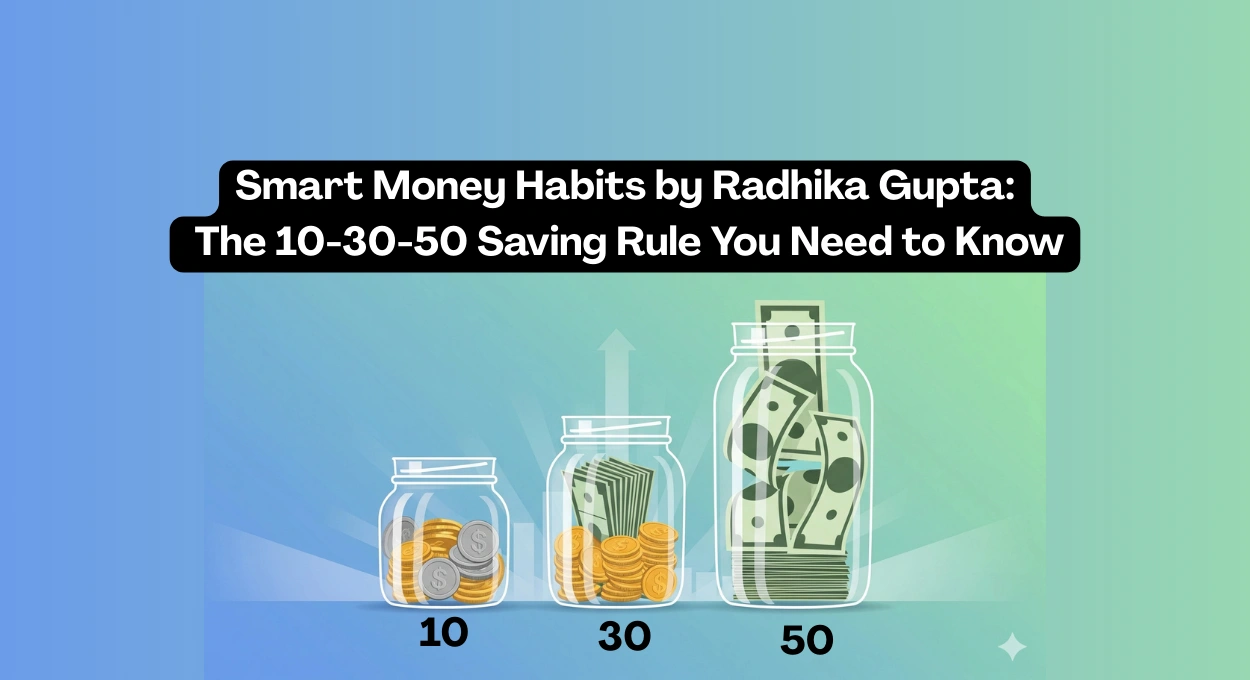

The 10-30-50 Rule by Radhika Gupta: A Simple Path to Smart Savings

When it comes to managing money, most people struggle with the balance between enjoying life and saving for the future. Radhika Gupta, CEO of Edelweiss Mutual Fund and author of Mango Millionaire, offers a simple yet powerful framework to solve this problem — the 10-30-50 Rule.

This rule recommends saving 10% of your income in your 20s, 30% in your 30s, and 50% in your 40s and beyond. It is not about rigid numbers but about building a lifelong habit of financial discipline that grows with your career and responsibilities.

In this article, we’ll break down the 10-30-50 saving rule, its benefits, and how you can apply it in your own life.

What is the 10-30-50 Rule?

The 10-30-50 rule is a progressive savings strategy designed to match your financial habits with your life stage. Instead of pushing you to save an unrealistic portion of your income from the start, it grows step by step.

- In your 20s – Save 10% of income

Gupta emphasizes that starting early is more important than the actual amount. Even if you begin by saving just 1% of your salary, it builds the habit. The 20s are often marked by student loans, low starting salaries, and lifestyle temptations. But making saving automatic at this stage is like “net practice” for financial success. - In your 30s – Save 30% of income

As you progress in your career, your income usually grows. This is the time to step up your savings. The 30s often bring big financial goals like buying a house, raising children, or planning for long-term investments. Saving 30% ensures you are building wealth while managing responsibilities. - In your 40s – Save 50% of income

Gupta calls this the “wealth sprint.” By now, most professionals are at their peak earning years. At the same time, large expenses such as children’s education and retirement planning become critical. By saving half of your income, you can create a strong financial cushion for the future.

Also Read :- The 30-30-30-10 Rule: A Smarter Way to Budget in 2025

How to Implement the 10-30-50 Rule

Radhika Gupta suggests making saving as easy as paying taxes. She calls it Savings Deducted at Source (SDS). Just like TDS (Tax Deducted at Source), the money for savings should leave your account before you even think about spending.

Here are some practical steps:

- Automate savings: Use Systematic Investment Plans (SIPs), Recurring Deposits (RDs), or Fixed Deposits (FDs) to automatically deduct savings every month.

- Start small, grow big: If 10% feels tough in your 20s, even 1-5% works. Increase it as your salary grows.

- Balance lifestyle and savings: Gupta stresses that saving is not about sacrifice. You can enjoy travel, experiences, and hobbies while still investing in your future.

- Use financial tools wisely: Diversify between mutual funds, equity, and debt depending on your risk profile.

Why the 10-30-50 Rule Works

Many young professionals feel trapped between the “YOLO” (You Only Live Once) lifestyle and the fear of not having enough for retirement. The 10-30-50 rule solves this dilemma.

- Habit over amount: It is easier to start saving small and increase gradually than to suddenly cut back on expenses later.

- Adapts to life stages: The rule matches your income growth and financial responsibilities.

- Balances present and future: It ensures you can enjoy life today while building security for tomorrow.

- Encourages discipline: By automating savings, you avoid the temptation of overspending.

Radhika Gupta’s Philosophy

Through her book Mango Millionaire and her public talks, Gupta simplifies financial discipline for millennials and Gen Z. She believes that wealth creation doesn’t have to come at the cost of lifestyle. Instead, smart saving and strategic investing can help you live well today and secure tomorrow.

Her relatable style — blending personal finance with real-life stories — makes the 10-30-50 rule not just a financial strategy but a life habit.

Also Read :- Why Patience Is the Most Powerful—and Hardest—Investment Strategy

Summary Table

| Life Stage | Savings Target | Why It Matters |

|---|---|---|

| 20s | 10% | Build the habit early, start small |

| 30s | 30% | Higher income, serious financial goals |

| 40s+ | 50% | Peak earnings, prepare for retirement and major expenses |

Final Thoughts

The 10-30-50 rule by Radhika Gupta is a realistic, easy-to-follow strategy for wealth creation. It doesn’t force you to give up your lifestyle but encourages progressive savings that grow with you.

If you’re in your 20s, start small but start today. In your 30s, increase your savings as responsibilities rise. And in your 40s, sprint towards financial independence.

Remember, building wealth is not about choosing between YOLO and discipline — it’s about balance. The earlier you adopt this mindset, the smoother your financial journey will be.

FAQs

Q1. What is the 10-30-50 rule by Radhika Gupta?

The 10-30-50 rule is a progressive savings framework where you save 10% of income in your 20s, 30% in your 30s, and 50% in your 40s to build long-term wealth.

Q2. Why should I start saving only 10% in my 20s?

Radhika Gupta emphasizes that building the habit is more important than the percentage. Even saving 1–10% helps cultivate financial discipline early.

Q3. How can I practically follow the 10-30-50 rule?

You can automate savings through SIPs, RDs, or FDs. Gupta recommends using the SDS (Savings Deducted at Source) approach, similar to TDS, so you save before you spend.

Q4. Is the 10-30-50 rule suitable for everyone?

Yes, it is flexible. While the percentages serve as a guide, the main principle is progressive saving—start small and increase as your income and responsibilities grow.

Q5. How does the 10-30-50 rule help balance lifestyle and saving?

The rule avoids extreme sacrifices. It allows you to enjoy experiences and lifestyle in your 20s while steadily increasing savings in later decades for security and growth.