10-Year Mutual Fund Returns Compared: Large, Mid, and Small Cap Insights

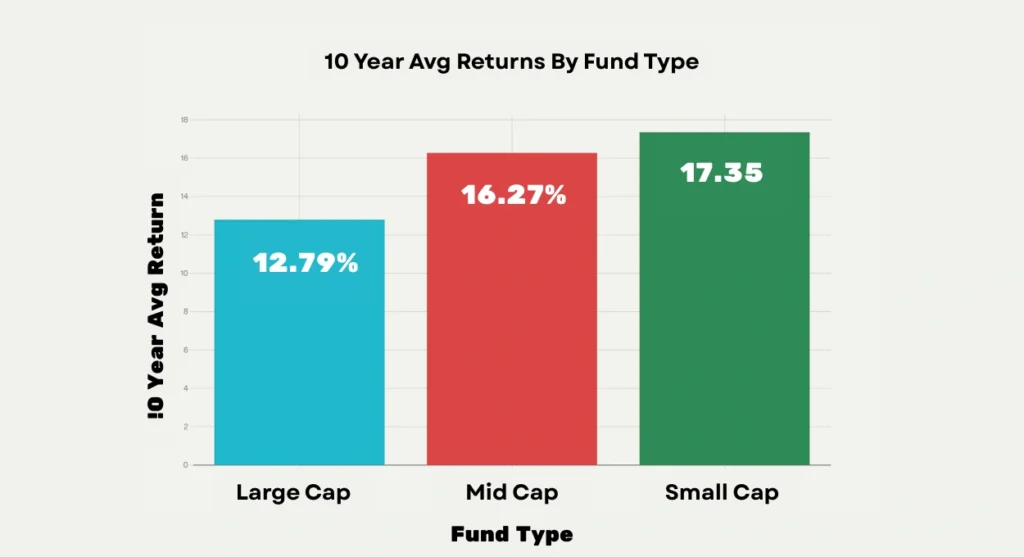

Over the last decade (2014–2024), 10-year mutual fund returns have shown a clear trend across categories. Small-cap mutual funds delivered the highest average returns at 17.35%, followed by mid-cap funds at 16.27%, while large-cap funds provided more stable but lower returns at 12.79%. This comparison of large cap vs mid cap vs small cap mutual funds highlights the classic risk-return trade-off investors must consider when building long-term portfolios.

Performance Overview

The last decade shows a clear hierarchy among equity mutual funds:

- Small-cap funds: 17.35% average returns, the highest across categories.

- Mid-cap funds: 16.27% returns, striking a balance between growth and risk.

- Large-cap funds: 12.79% returns, more stable but lower compared to others.

This makes small caps attractive for aggressive investors, mid caps for balanced portfolios, and large caps for conservative investors seeking consistency.

Also Read :- 5 Best-Performing Debt Funds in India with 5-Year Returns Up to 22%

Category-Wise Insights

Large-Cap Funds: Stability Over Growth

These funds invest in India’s top 100 companies by market capitalization. Their key advantage is stability and lower volatility, though returns are moderate.

Top performers (10 years):

- Quant Focused Fund: 16.03%

- Nippon India Large Cap Fund: 15.68%

- ICICI Prudential Large Cap Fund: 15.60%

- Canara Robeco Large Cap Fund: 15.52%

- Invesco India Largecap Fund: 14.90%

Best suited for conservative investors prioritizing steady returns.

Mid-Cap Funds: Balanced Choice

Mid-cap funds invest in companies ranked 101–250 by market cap, offering a mix of growth and stability.

Top performers (10 years):

- Invesco India Mid Cap Fund: 20.33%

- Kotak Midcap Fund: 19.82%

- Edelweiss Mid Cap Fund: 19.60%

- Motilal Oswal Midcap Fund: 19.29%

- Nippon India Growth Mid Cap Fund: 18.98%

Ideal for investors with moderate risk appetite seeking higher growth potential than large caps.

Small-Cap Funds: High Risk, High Reward

These funds target companies ranked 251+ by market cap. Despite higher volatility, they outperformed with stellar returns.

Top performers (10 years):

- Nippon India Small Cap Fund: 22.67%

- Axis Small Cap Fund: 20.43%

- Quant Small Cap Fund: 20.34%

- SBI Small Cap Fund: 20.33%

- HDFC Small Cap Fund: 20.17%

Best for aggressive investors with a long-term horizon and higher risk tolerance.

Risk-Return Trade-Off

- Large-cap funds: Low risk, steady returns, high liquidity.

- Mid-cap funds: Balanced risk-reward, moderate volatility.

- Small-cap funds: High risk, high volatility, but maximum upside.

Experts caution that as of 2025, small-cap valuations are trading at a premium, suggesting investors should avoid overexposure.

Investor Takeaways

- Conservative investors: Stick with large caps.

- Balanced portfolios: Add mid caps for higher growth potential.

- Aggressive investors: Small caps can deliver strong long-term gains but require patience and risk appetite.

Smart Strategy for 2025: Diversify across all three categories, invest via SIPs, and rebalance portfolios regularly.

FAQs (Frequently Asked Questions)

1. Which type of mutual fund performed best over the last 10 years?

Small-cap funds led with an average 17.35% return, followed by mid-cap at 16.27%, while large-cap funds delivered 12.79% returns.

2. What is the main difference between large-cap, mid-cap, and small-cap funds?

The difference lies in company size and risk: large-caps are stable, mid-caps balance growth and safety, while small-caps are volatile but high-growth.

3. Are large-cap funds safer than mid-cap and small-cap funds?

Yes. Large-cap funds are relatively low-risk due to their investment in established companies, making them less volatile than mid- and small-cap funds.

4. Who should invest in mid-cap mutual funds?

Mid-cap funds suit investors with a moderate risk appetite, seeking a balance between the stability of large caps and the growth potential of small caps.

5. Are small-cap mutual funds risky for long-term investors?

Small-cap funds are volatile in the short term but can generate strong long-term wealth. They are best for aggressive investors with high risk tolerance.