Why Patience Is the Most Powerful—and Hardest—Investment Strategy

When it comes to wealth creation, patience in investing is the ultimate superpower. Yet, it’s also the most difficult trait for most investors to practice. In a world driven by instant gratification, staying invested for years—sometimes decades—feels counterintuitive. But history proves that patient investors consistently outperform those who chase short-term gains.

The Power of Patience in Numbers

To see why patience pays off, let’s look at some real examples.

| Investment | Holding Period | CAGR (Annual Growth) | Final Value of ₹1 Lakh | Key Lesson |

|---|---|---|---|---|

| Nifty 50 Index Fund | 10 years (2013–2023) | ~13% | ₹3.40 lakhs | Index funds reward patient investors. |

| Infosys | 20 years (2003–2023) | ~22% | ₹50 lakhs+ | Long-term compounding in action. |

| HDFC Bank | 25 years (1998–2023) | ~20% | ₹38 lakhs+ | A market leader multiplies wealth. |

| Bitcoin | 10 years (2013–2023) | ~80%+ | ₹1 lakh → ₹700+ crores | Extreme patience = extreme results. |

These numbers reveal the simple truth: time in the market beats timing the market.

Real-Life Example: Warren Buffett

Warren Buffett built his fortune not by making quick trades but by holding companies for decades.

- His Coca-Cola investment (bought in 1988) is still in his portfolio.

- Initial investment: $1.3 billion

- Current value: $25 billion+

- Lesson: Patience in investing turns great companies into life-changing wealth.

Why Patience in Investing Works

- Compounding Magic – The longer your money stays invested, the more it multiplies.

- Market Volatility Smooths Out – Short-term dips become insignificant over long horizons.

- Lower Taxes & Costs – Fewer trades = fewer capital gains taxes and brokerage fees.

- Emotional Stability – Patience helps avoid panic selling during crashes.

Also Read :- The Golden Rule of Compounding: Lessons from Charlie Munger

Common Traps That Kill Patience

Even seasoned investors lose patience. Here are some traps to watch out for:

| Trap | How It Hurts | Example |

|---|---|---|

| Chasing Hot Stocks | Leads to buying high, selling low | Tech bubble of 2000 |

| Checking Portfolio Daily | Creates anxiety and impulsive decisions | Investors selling in March 2020 crash |

| Following the Herd | Herd mentality destroys returns | Yes Bank collapse (2018–2020) |

| Ignoring Fundamentals | Short-term hype fades, fundamentals remain | Paytm IPO example |

A Modern Example: Indian Markets

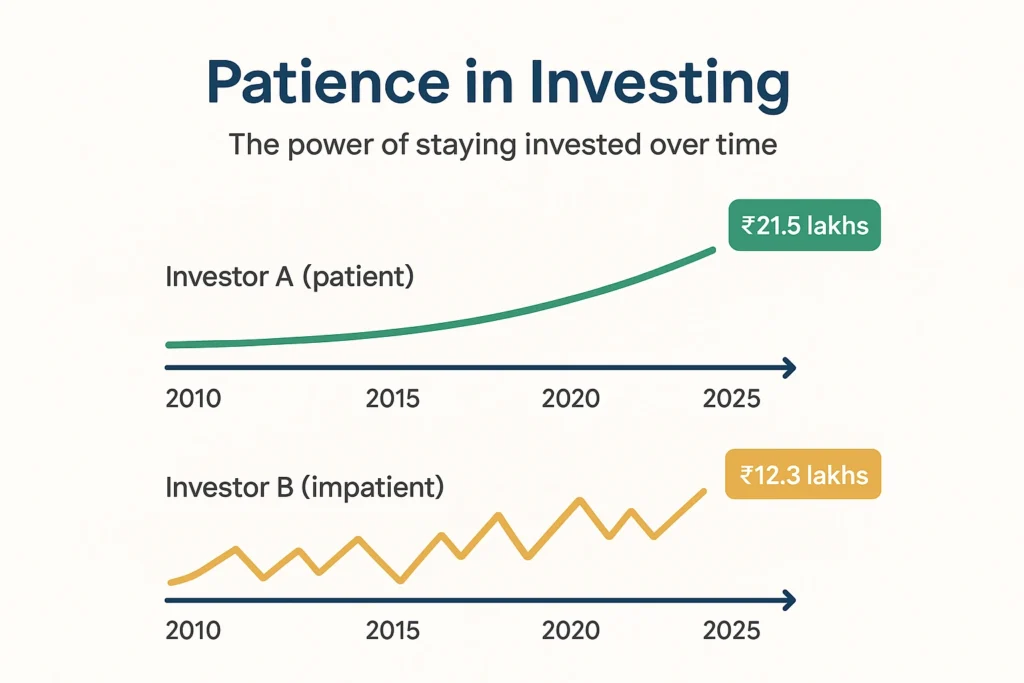

Imagine two investors who each invested ₹5 lakhs in the Nifty 50 in 2010.

- Investor A (patient): Held without interruption until 2025.

- Value in 2025 = ₹21.5 lakhs

- Investor B (impatient): Tried to time the market, missed the 10 best trading days.

- Value in 2025 = ₹12.3 lakhs

The difference is ₹9.2 lakhs lost simply due to lack of patience in investing.

How to Build Patience in Investing

- Automate Investments – Use SIPs (Systematic Investment Plans) to stay consistent.

- Set Long-Term Goals – Focus on 10–20 years, not 10–20 days.

- Avoid Market Noise – Don’t get distracted by daily news or Twitter chatter.

- Track Businesses, Not Prices – Focus on company fundamentals.

- Learn from Great Investors – Buffett, Rakesh Jhunjhunwala, Vijay Kedia—all preached patience.

Also Read :- Securing Your Retirement with Mutual Funds: A Simple Yet Powerful Strategy

Final Word

Patience in investing isn’t just a virtue—it’s the strategy that separates successful investors from average ones. Whether you’re holding index funds, blue-chip stocks, or even emerging assets like crypto, the longer you allow your money to compound, the greater the rewards.

Remember: The stock market is a device for transferring money from the impatient to the patient.

FAQs (Frequently Asked Questions)

1. Why is patience key in investing?

Patience maximizes compounding and reduces risk, with the Nifty 50 showing 100% positive returns over 10+ years.

2. How does compounding work?

Compounding lets your investment returns earn returns, leading to exponential growth over time, especially in later years.

3. What is rupee cost averaging?

It’s a strategy where regular investments (like SIPs) buy more units at lower prices, reducing average costs and leveraging volatility.

4. Why is patience hard in investing?

Human biases like loss aversion, overconfidence, and FOMO, amplified by constant market updates, drive impulsive decisions.

5. How can I stay patient as an investor?

Automate SIPs, focus on long-term goals, diversify, embrace market dips, and limit portfolio checks to yearly reviews.

6. What tax benefits come with patient investing?

Long-term capital gains (over 1 year) are taxed at 12.5% (above ₹1.25 lakh), and ELSS funds offer ₹1.5 lakh deductions under Section 80C.

7. How does volatility benefit patient investors?

Dips let you buy quality assets cheaper, boosting returns when markets recover, as seen in 2009 and 2021 rallies.

Disclaimer :- This article is for educational purposes only and does not constitute financial advice. Investing involves risks, and past performance is not indicative of future returns. Please consult a qualified financial advisor before making decisions.