How Many Mutual Funds Are Enough for a Balanced Portfolio?

When building an investment portfolio, one question often stumps investors—“How many mutual funds should I own?”

It’s easy to assume that more funds mean better diversification and higher safety. But in reality, owning too many mutual funds can reduce clarity, increase cost, and ironically, dilute your returns. A balanced portfolio doesn’t require 10–15 funds. In most cases, 3 to 5 well-chosen mutual funds are more than enough.

Let’s understand why.

Why “More” Isn’t Always “Better”

While diversification is essential, over-diversification can lead to what experts call “diworsification.” Many mutual funds already hold dozens—even hundreds—of securities within them. So, having too many of them often results in duplication, inefficiency, and confusion.

Here’s a closer look:

| Reason | Why It Matters |

|---|---|

| Built-in diversification | A single equity mutual fund may hold 40–100+ stocks, eliminating most individual stock risk. |

| Diminishing returns from extra funds | Research shows that beyond 20–25 well-chosen stocks (i.e., 1–2 mutual funds), additional diversification offers minimal risk reduction. |

| Overlapping portfolios | Many mutual funds have over 50% of the same top holdings—leading to redundancy and unnecessary fees. |

| Same-category duplication | Two funds from the same SEBI category (e.g., large-cap) rarely provide added value. Choose the best one. |

| Lack of clarity | If you can’t clearly define what each fund does in your portfolio, it’s probably not serving a strategic purpose. |

Also Read :- Are You Overdiversifying? The Hidden Risks of Too Many Index Funds for Indian Investors

How Many Mutual Funds Do You Really Need?

The right number of funds depends on your financial goals, risk appetite, and investment horizon. But here’s a general guide:

| Investor Profile | Ideal Number of Funds | Fund Types |

|---|---|---|

| Beginner | 2–4 funds | Index fund, debt fund, ELSS, optional international fund |

| Seasoned investor | 3–5 funds | Core equity + debt + 1–2 thematic/sectoral funds |

| High net-worth individuals | 5–8 funds | Multiple asset classes, global exposure, tax-optimized index variants |

When Is More Than 5 Funds Justified?

In some special cases, holding more than five funds might make sense:

- Large portfolios (₹5 crore+): When spread across different account types (individual, joint, HUF, retirement), some duplication is tax-efficient.

- Factor-tilted investing: If you’re actively allocating to small-cap, value, or momentum factors, you may need 1–2 more index funds.

- Target-date or life-cycle funds: You might opt for one fund that does everything automatically—but if you still hold legacy funds, you may briefly have more.

Even then, experts recommend staying below 10–12 funds total. More than that is rarely justified.

Also Read :- Goal-Based Financial Planning: Your Personal Roadmap to Financial Freedom

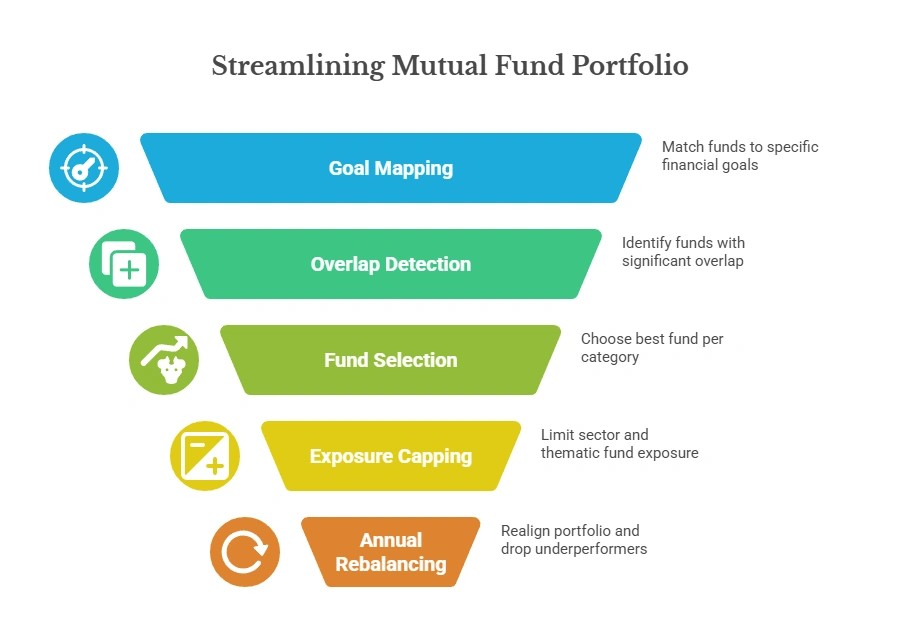

Step-by-Step Guide to Streamlining Your Mutual Fund Portfolio

Here’s a simple checklist to help you right-size your mutual fund holdings:

1. List All Your Funds

Write down every mutual fund you own. Include:

- Fund category (e.g., large-cap, hybrid, debt)

- Expense ratio

- Top 10 holdings

2. Map Each Fund to a Goal

Match each fund to a specific goal—like retirement, children’s education, home down payment, or emergency fund. If you can’t link a fund to a goal, question why it’s there.

3. Detect Portfolio Overlap

Use mutual fund overlap tools (freely available online) or manually compare top holdings. If two funds have over 50% overlap, you may be paying twice for the same investment.

4. Retain One Best Fund Per Category

If you own multiple funds in the same category, keep:

- The one with lower cost (expense ratio)

- Consistent long-term performance

- Aligned investment strategy

Exit the others gradually to avoid tax hits.

5. Cap Satellite Exposure

Sector and thematic funds should be <10% each of your portfolio. They’re volatile and best used as tactical tools, not core holdings.

6. Rebalance Yearly

Annually revisit your portfolio to:

- Realign with original allocation

- Drop underperformers

- Avoid adding new funds impulsively

Also Read :- Top Tax-Free Investments for Retirees in India (2025 Edition)

Real-World Examples

Ramesh (Age 30, Monthly SIP ₹15,000)

Current Portfolio:

- Axis Bluechip Fund

- Mirae Asset Large Cap Fund

- SBI Bluechip Fund

Problem: All three are large-cap funds with similar top holdings (Reliance, HDFC, Infosys, ICICI Bank).

Solution: Ramesh consolidates into one top-performing large-cap fund and adds:

- 1 debt fund for stability

- 1 international fund for diversification

Final Portfolio: 3 funds — clean, diversified, and goal-aligned.

Priya (Age 24, New Investor)

Goal: Start investing for long-term wealth and tax saving.

Recommended Portfolio:

- Nifty 50 index fund (core equity)

- ELSS fund (tax-saving under 80C)

- Liquid fund (emergency needs)

Total funds: 3 — simple, effective, and easy to manage.

Common Myths Around Mutual Fund Count

| Myth | Reality |

|---|---|

| “More funds = more safety” | Only true up to a point. Beyond 5–6, added funds mostly create clutter. |

| “Every goal needs a new fund” | You can map multiple goals to the same fund, using internal tracking. |

| “Switching funds too often improves returns” | Timing funds is like timing markets—it usually backfires. Stay consistent. |

| “All good funds deserve a place in my portfolio” | Pick the best in each category. Good ≠ necessary. |

Also Read :- Avoiding Portfolio Over-Diversification: Smart Strategies for Investors

Bottom Line: Keep It Simple, Focused, and Goal-Based

The ideal mutual fund portfolio isn’t about owning every top-rated fund. It’s about:

- Purposeful fund selection

- Minimizing cost and overlap

- Maximizing clarity and discipline

If you can’t explain why each fund is in your portfolio in one sentence, it may be time to consolidate.

Quick Summary:

| Portfolio Size | Ideal Fund Count |

|---|---|

| Small (₹0–5L) | 2–3 funds |

| Medium (₹5L–50L) | 3–5 funds |

| Large (₹50L+) | 5–8 funds (max 10–12 in rare cases) |

Keeping your mutual fund investments simple, cost-effective, and goal-aligned is the smartest strategy in the long run.

FAQs (Frequently Asked Questions)

Q1. Is it bad to have too many mutual funds?

Yes. Too many mutual funds often lead to portfolio overlap, higher expense ratios, and confusion. Stick to 3–5 funds for simplicity and better control.

Q2. Can I hold multiple funds in the same category?

It’s possible but not recommended unless their strategies differ significantly. Otherwise, choose the best performer with low cost.

Q3. How do I check if my funds overlap?

Use free online tools or compare the top 10 holdings of your funds manually. If overlap exceeds 50%, consider consolidating.

Q4. Is it okay to invest in only 1 or 2 mutual funds?

Yes, especially if you’re a beginner. A single diversified fund or a three-fund strategy can provide sufficient exposure and balance.

Q5. What’s a three-fund portfolio?

A simple, powerful investment model using one equity fund, one debt fund, and one international or hybrid fund for balanced exposure.