Leela Hotels IPO: Should You Invest in This Luxury Hospitality Giant?

India’s luxury hospitality sector is buzzing, and Leela Hotels is right at the centre of it. Backed by Brookfield Asset Management and known for its world-class properties, Leela Hotels is all set to launch its much-anticipated IPO. If you’re thinking about investing in the stock market and looking for opportunities in the premium travel and hospitality space, this could be your moment.

Let’s break down everything you need to know about the Leela Hotels IPO—plain and simple.

Table of Contents

ToggleImportant Dates to Remember

-

Anchor investor bidding: Starts on May 23, 2025

-

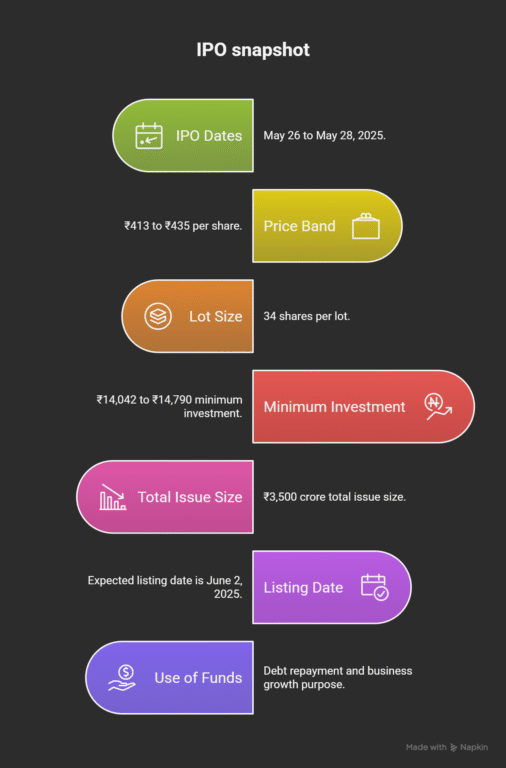

IPO opens for everyone: May 26, 2025

-

IPO closes: May 28, 2025

-

Allotment date: May 29, 2025

-

Expected listing date: June 2, 2025 (on NSE & BSE)

IPO Size and Structure

The total IPO size is ₹3,500 crore, which is slightly lower than the previously planned ₹5,000 crore.

Here’s how it’s divided:

-

Fresh Issue: ₹2,500 crore (around 57.5 million new shares)

-

Offer for Sale (OFS): ₹1,000 crore (23 million shares by Brookfield Asset Management)

This means a big chunk of the money raised will go straight to the company to support its future growth.

How Will the Funds Be Used?

Leela Hotels plans to use the IPO money mainly for repaying debts. Out of ₹2,500 crore from the fresh issue, ₹2,300 crore will be used to clear loans and reduce the company’s financial burden. This is a strong signal that Leela is aiming to become leaner, more profitable, and future-ready.

The rest of the funds will be used for general corporate purposes.

Also Read :- https://ipofront.in/listing-day-performances-sme-ipos-march-2025/

Price Band and Investment Details

-

Price Band: ₹413 to ₹435 per share

-

Lot Size: 34 shares per lot

-

Minimum Investment (Retail): ₹14,042 (at ₹413) or ₹14,790 (at ₹435)

-

Maximum for retail investors: Up to 13 lots

This means you can start investing with around ₹14,000, making it quite accessible for retail investors looking for premium long-term opportunities.

Who Can Invest?

The IPO is divided among different types of investors:

-

75% reserved for Qualified Institutional Buyers (QIBs)

-

15% for Non-Institutional Investors (NIIs)

-

10% for Retail Investors (that’s you!)

Although only 10% is reserved for retail, the company’s strong brand and future potential make it worth considering.

Also Read :-https://ipofront.in/balaji-phosphates-ipo-a-closer-look-at-the-listing-day-and-performance/

About Leela Hotels (Schloss Bangalore)

Leela Hotels, operated by Schloss Bangalore, is one of India’s top luxury hotel brands. As of March 2025, it manages 13 premium properties with a total of 3,553 rooms. It competes with other big players in the industry like Taj (Indian Hotels), EIH (Oberoi), ITC Hotels, and Chalet Hotels.

The brand is known for its upscale experience, and being backed by Brookfield Asset Management adds a layer of financial strength and credibility.

Key Players Behind the Scenes

-

Registrar: Kfin Technologies

-

Book-Running Lead Managers (BRLMs):

JM Financial, Kotak Mahindra Capital, Axis Capital, Morgan Stanley, ICICI Securities, SBI Capital Markets, and more.

This impressive lineup of financial heavyweights ensures credibility and a smooth IPO process.

Why You Might Want to Invest

Let’s be honest—IPOs come with risk, but they also come with potential rewards. Here’s why Leela Hotels might be a smart move:

1. Strong Brand and Loyal Customer Base

Leela is a well-established luxury hotel chain with a reputation for excellence. In a post-COVID world where premium travel is bouncing back, this is a big deal.

2. Focus on Reducing Debt

Using most of the IPO proceeds to repay loans shows that the company wants to improve its balance sheet. Lower debt often means higher profitability.

3. Backed by Brookfield

Brookfield Asset Management is a global giant. Its involvement adds credibility and long-term vision.

4. Tourism is Booming Again

With domestic and international tourism picking up pace, Leela Hotels is well-positioned to ride the hospitality wave.

Also Read :- https://ipofront.in/readymix-ipo-listing-performance/

Things to Consider Before Investing

-

The hospitality sector can be cyclical and sensitive to economic changes.

-

Only 10% of shares are available for retail investors, so demand might outstrip supply.

-

Stock prices can fluctuate a lot post-listing. Make sure this aligns with your risk appetite.

Final Thoughts: Should You Apply?

If you believe in India’s luxury hospitality story and want to invest in a well-known brand aiming to grow stronger financially, the Leela Hotels IPO could be a promising opportunity. It’s a mix of glamour and growth with a reasonable entry point.

As always, do your due diligence and make sure this investment fits into your long-term goals. But if you’re looking to own a slice of India’s luxury travel future—this IPO might be your ticket in

FAQs (Frequently Asked Questions)

1. When is the Leela Hotels IPO opening?

The Leela Hotels IPO opens for subscription on May 26, 2025, and closes on May 28, 2025. Anchor bidding begins on May 23, 2025.

2. What is the price band and lot size for Leela Hotels IPO?

The price band is ₹413 to ₹435 per share. The minimum lot size is 34 shares, which requires an investment of around ₹14,042–₹14,790.

3. How will Leela Hotels use the IPO proceeds?

₹2,300 crore out of ₹2,500 crore from the fresh issue will go toward repaying debt, with the rest for general corporate purposes.

4. Is Leela Hotels IPO a good investment in 2025?

Leela Hotels is a luxury brand with strong financial backing from Brookfield. It could be a solid long-term investment, especially as tourism rebounds.

5. On which exchanges will Leela Hotels IPO be listed?

The IPO is expected to list on both NSE and BSE on June 2, 2025.