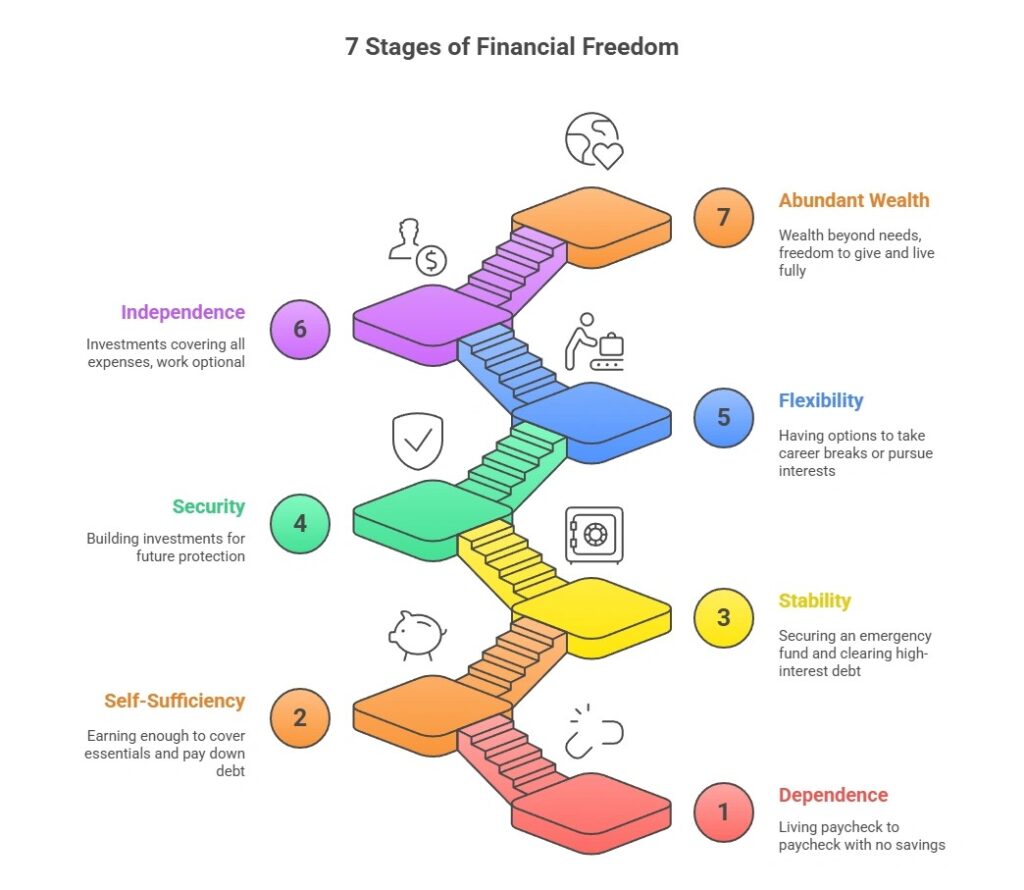

7 Stages of Financial Freedom — Can You Identify Where You Are Today?

Financial freedom isn’t a single destination but a journey with distinct, measurable stages. Understanding where you are today is the most critical step toward developing a clear, targeted strategy to reach your goals. Based on the framework from financial experts like Grant Sabatier, author of “Financial Freedom,” here is a comprehensive guide to the seven stages of financial independence.

Stage 1: Clarity (Dependence)

What it means: This is your starting point, where you’re gaining a full understanding of your financial reality. You might be financially dependent on others (family, spouse) or living paycheck to paycheck without a clear picture of your finances.

Key characteristics:

- You rely on others for basic living expenses.

- You have no clear understanding of your income, expenses, assets, or liabilities.

- You may be accumulating debt without even realizing it.

- You lack financial goals or a solid plan.

How to move forward:

- Create a detailed budget to track every rupee you earn and spend.

- Calculate your net worth by subtracting liabilities from assets.

- Set clear, achievable financial goals, both short-term and long-term.

- Begin building your financial literacy by reading books or taking courses.

Stage 2: Self-Sufficiency

What it means: You are now able to cover all your basic living expenses on your own, without relying on anyone else. However, you may still be living paycheck to paycheck with little to no savings.

Key characteristics:

- Your income is sufficient to cover essential expenses like rent, utilities, food, and transport.

- You are no longer financially dependent on family or friends.

- You may have debt or very minimal savings.

- A paycheck-to-paycheck lifestyle is common.

How to move forward:

- Adopt a simple budgeting rule like the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings).

- Start building a small emergency fund, even if it’s just a few thousand rupees.

- Find ways to increase your income, perhaps through a side hustle or skill development.

- Begin paying down any high-interest debt aggressively.

Stage 3: Breathing Room

What it means: You have successfully broken the paycheck-to-paycheck cycle. You now have money left over each month, which you can use for discretionary spending and savings.

Key characteristics:

- You have a consistent monthly surplus after all expenses are paid.

- You can afford occasional treats like dining out or entertainment.

- You are actively building an emergency fund.

- Your financial stress about monthly bills is significantly reduced.

How to move forward:

- Focus on building your emergency fund to a comfortable 3-6 months of living expenses.

- Continue to pay down any remaining high-interest debt.

- Start investing small, regular amounts through Systematic Investment Plans (SIPs) in mutual funds.

- Be careful to avoid lifestyle inflation as your income grows.

Also Read :- 5 Hidden Mutual Fund Traps That Could Delay Your Financial Freedom

Stage 4: Stability (Security)

What it means: You have a robust financial foundation. You’ve fully funded your emergency fund and have eliminated all high-interest debt, giving you a strong sense of security against unexpected expenses.

Key characteristics:

- Your emergency fund can cover 6-12 months of expenses.

- High-interest debt (like credit cards or personal loans) is gone.

- You have a stable, predictable cash flow.

- You are no longer worried about a job loss or major unexpected expenses.

How to move forward:

- Increase your savings and investment rate to 20-30% of your income.

- Begin investing more aggressively in equity mutual funds to grow your wealth faster.

- Look for opportunities to create additional income streams.

- Start planning for major long-term goals like buying a home or your retirement.

Stage 5: Flexibility (Freedom of Time)

What it means: You have built significant financial flexibility. You now have enough saved to take calculated risks, such as changing careers, starting a business, or taking time off from work without any financial worry.

Key characteristics:

- You have 1-2 years of living expenses saved beyond your emergency fund.

- Your investment portfolio is beginning to generate meaningful returns.

- Work is still a part of your life, but you have the freedom to take time off or pursue passion projects.

- You can make career or life changes without financial fear.

How to move forward:

- Diversify your income sources through smart investments and side businesses.

- Continue to build your investment portfolio aggressively.

- Consider exploring alternative investments like real estate.

- Work on optimizing your tax strategies to accelerate wealth building.

Stage 6: Financial Independence

What it means: This is the ultimate goal for many. Your passive income streams and investment returns are now enough to cover all your basic living expenses, making work an option rather than a necessity.

Key characteristics:

- Your investment income covers 100% of your annual expenses.

- You have reached the point where you could retire today.

- You follow the 4% withdrawal rule, meaning you have at least 25 times your annual expenses invested.

- You have multiple passive income streams.

How to move forward:

- Fine-tune your investment strategy to ensure your wealth is preserved and grows steadily.

- Focus on tax-efficient withdrawal strategies for your retirement.

- Consider building additional passive income streams to create a bigger financial cushion.

Also Read :- The 30-30-30-10 Rule: A Smarter Way to Budget in 2025

Stage 7: Abundant Wealth (Financial Freedom)

What it means: You have reached a point where you have significantly more money than you’ll ever need. Money is no longer a daily concern, and you have complete freedom to live your ideal lifestyle.

Key characteristics:

- Your wealth far exceeds your lifetime needs.

- You have the ability to be philanthropic and give generously.

- Financial decisions are no longer a source of stress or limitation.

- You have the freedom to pursue any lifestyle or passion project you desire.

How to move forward:

- Focus on wealth preservation and legacy planning.

- Engage in meaningful philanthropy and use your wealth to create a positive social impact.

How to Identify Your Current Stage

To figure out where you stand on this journey, ask yourself these key questions:

- Emergency Fund: How many months of your living expenses are currently saved in an emergency fund?

- Debt: Do you have any high-interest debt like credit card balances or personal loans?

- Savings Rate: What percentage of your income do you save and invest each month?

- Investment Income: How much of your annual expenses could be covered by your investment returns alone?

- Financial Stress: How often do you feel worried or stressed about money?

Based on your answers, you can score yourself:

- Stages 1-2: You have limited savings, high debt, and often live paycheck to paycheck.

- Stages 3-4: Your emergency fund is growing, debt is shrinking, and you’re saving consistently.

- Stages 5-6: You have substantial savings, your investment income is growing, and you are less dependent on your job.

- Stage 7: Your investment income exceeds your needs, and money is no longer a concern.

The Indian Context

The journey to financial freedom in India has its own unique flavour. While challenges like higher inflation in education and healthcare exist, Indian investors also have advantages like a strong cultural tendency to save and growing investment opportunities. It’s important to remember that achieving financial independence in India is highly feasible with discipline. For example, if your annual expenses are ₹10 lakhs, you would need approximately ₹2.5 crores invested to achieve Financial Independence (Stage 6) by following the 4% withdrawal rule.

Key Takeaways

- Progress is not always linear: You might move back and forth between stages due to life events.

- Each stage requires a different strategy: The steps you take at Stage 2 are different from those at Stage 5.

- Time is your greatest asset: The earlier you start, the more powerful compounding becomes.

- Consistency over perfection: Small, regular actions are far more effective than trying to be perfect.

Start your journey today by honestly assessing where you are, then focus on the specific actions that will move you to the next stage.

FAQs

Q1. What are the 7 stages of financial freedom?

The 7 stages include: Clarity (dependence), Self-sufficiency, Stability, Security, Flexibility, Financial Independence, and Abundant Wealth. Each stage reflects progress toward financial security and freedom.

Q2. How do I know what stage of financial freedom I am in?

Assess your emergency fund, debt status, savings rate, and whether investments can cover your expenses. These indicators will help place you on the spectrum.

Q3. How much money do I need to achieve financial independence in India?

A common rule is the 25x rule: multiply your annual expenses by 25. For example, if you spend ₹10 lakh annually, you need ₹2.5 crore invested to be financially independent.

Q4. What is the difference between financial independence and financial freedom?

Financial independence means your investments cover your expenses. Financial freedom goes beyond that — you have abundant wealth, no financial stress, and the ability to live fully on your own terms.

Q5. Can an average salaried person in India achieve financial freedom?

Yes. With disciplined saving, systematic investing in mutual funds, controlling lifestyle inflation, and starting early, even a salaried individual can reach financial independence.